Warren Buffett is one of the most closely followed and studied investors in history. Since 1965, he’s led investment conglomerate Berkshire Hathaway and helped generate an overall return of 4,384,748%.

It’s fair to say that Buffett knows a thing or two about picking stocks. Some of the hallmarks of Buffett’s portfolio include financial services, energy businesses, and consumer goods companies. By contrast, one sector that Buffett notably stayed away from for years is technology.

However, in 2016, the Oracle of Omaha made a splash by revealing a massive position in Apple (NASDAQ: AAPL). Less than a decade later, the iPhone maker is now Buffett’s largest position — worth roughly $135 billion and accounting for nearly 41% of his total portfolio.

Let’s dig into why Buffett loves Apple stock so much, and assess if now is a good time for investors to scoop up some shares.

Buffett’s investment philosophy is surprisingly simple

You don’t need to be good at picking individual stocks to mimic Buffett’s success. In fact, much of Buffett’s investment philosophy revolves around exercising patience and discipline as opposed to trying to identify the “next big thing.”

Besides Apple, some of Buffett’s largest positions include Coca-Cola, American Express, Occidental Petroleum, Bank of America, and Chevron. The first key item to recognize here is that Buffett is well diversified.

What’s more important, however, is taking a look at how long Buffett has owned some of these companies. For example, Buffett has owned Coca-Cola stock since 1988. Although Coca-Cola may be seen by many as a mundane business, Buffett has enjoyed generous returns over the decades thanks to Coca-Cola’s reliable, steady growth and dividend program.

Apple is a bit of a different story, though. Buffett has owned Apple stock for less than a decade, and yet it’s already ballooned into his largest position.

Clearly, Apple has experienced outsize price appreciation in recent years. Now, with artificial intelligence (AI) taking the spotlight in the technology sector, could investors be looking at a generational opportunity in Apple right now?

Apple’s AI strategy has been revealed

Over the last couple of years, many big tech stalwarts have made splashy moves in the AI realm. Microsoft made a $10 billion investment in OpenAI, the developer behind ChatGPT. Moreover, Alphabet and Amazon each invested in a competitor to OpenAI, Anthropic.

The main thread stitching these investments together is that Microsoft, Amazon, and Alphabet compete fiercely with one another in the cloud computing landscape.

Unlike its peers above, Apple remained suspiciously quiet as it related to its AI ambitions. Considering the company’s sales have been in decline for about a year now, I found the lack of an AI roadmap to be unnerving.

However, about a month ago during its Worldwide Developers Conference (WWDC), management finally provided investors with a preview of Apple Intelligence — the company’s long-awaited strategy around AI.

Apple will be partnering with OpenAI to integrate ChatGPT across its suite of hardware products as it looks to bring AI-powered applications to the masses.

Apple’s WWDC took place from June 10 to June 14. And since June 10, shares of Apple have soared by 16%.

Unsurprisingly, over the last month many Wall Street analysts have revamped and upgraded their price targets for Apple stock as well.

Is the premium valuation worth it?

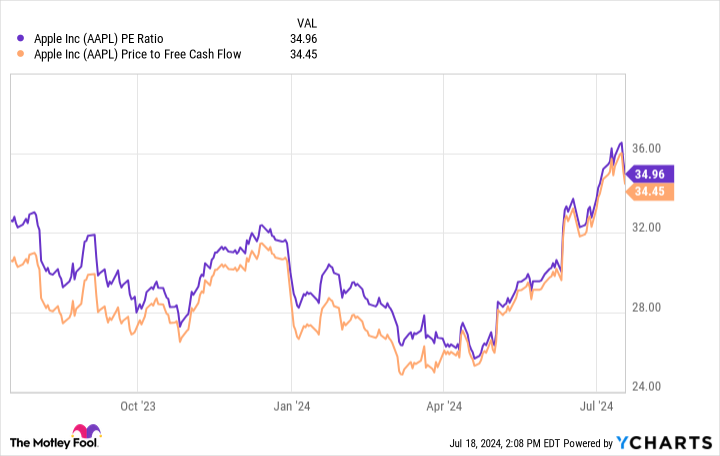

As illustrated in the chart below, Apple’s price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) multiples are significantly higher today than they were just a year ago. It’s hard for me to justify these premium multiples considering Apple has shown little in the way of growth or innovation for quite some time.

On the surface, it looks like investors are encouraged by the bullish sentiment surrounding Apple Intelligence that has led to significant buying activity in the stock. While it can be tempting to follow, buying into momentum is seldom a good strategy.

One other aspect that makes Buffett such a great investor is that he is a contrarian. Buffett does not follow the crowd or chase lofty valuations.

While Apple Intelligence is an intriguing development, the company has yet to show any tangible results from it yet. Furthermore, the initial Apple Intelligence product suite isn’t set to be released until the fall.

To me, it looks like investors are buying more into the story around Apple Intelligence, and the current outsize buying activity is rooted in emotional hype as opposed to prudent logic.

While the rising price in Apple stock is good for Berkshire and Buffett, I don’t think it’s warranted at the moment. Should the company begin to show a turnaround in sales, and perhaps later this year start translating Apple Intelligence into a significant source of growth, scooping up shares could be a good idea. But for now, I would not initiate a position in Apple or add to an existing one.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. American Express is an advertising partner of The Ascent, a Motley Fool company. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Bank of America, Berkshire Hathaway, Chevron, and Microsoft. The Motley Fool recommends Occidental Petroleum and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Billionaire Warren Buffett Has $135 Billion Invested in Just 1 Artificial Intelligence (AI) Stock. Is It Time to Buy? was originally published by The Motley Fool