Posted on: August 21, 2024, 04:14h.

Last updated on: August 21, 2024, 04:14h.

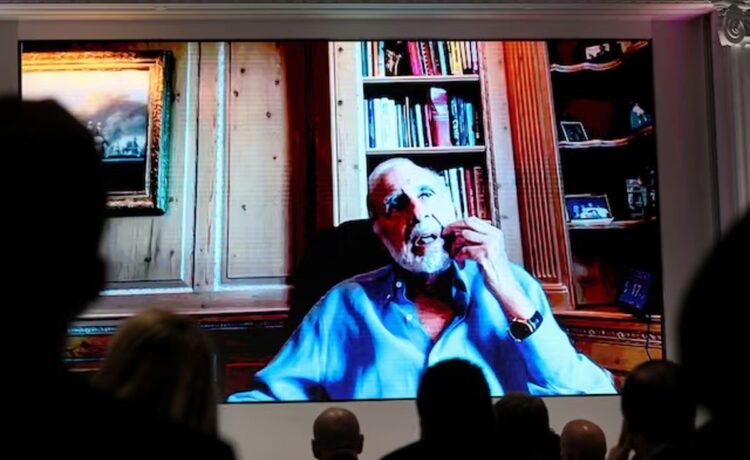

Billionaire Carl Icahn, 88, a longtime gaming industry investor who pushed for Eldorado Resorts’ reverse takeover of Caesars in 2019, has agreed to pay the U.S. Securities and Exchange Commission (SEC) $2 million to settle regulatory violations.

An independent agency of the United States federal government, the SEC’s primary purpose is to prevent market manipulation. The stock market regulator says that Icahn, from at least December 2018 through February 2022, failed to disclose his pledging of Icahn Enterprises L.P. (IEP) shares to secure personal margin loans worth billions of dollars.

Icahn, IEP’s controlling shareholder and board chair, pledged between 51% to 82% of IEP’s outstanding shares for more than $5 billion in loans from several lenders, the SEC said an investigation determined. Icahn and IEP were required by law to disclose that lending activity but did not.

“These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time,” said Osman Nawaz, chief of the SEC Enforcement Division’s Complex Financial Instruments Unit. “Due to both disclosure failures, existing and prospective investors were deprived of required information.”

IEP and Icahn agreed to settle the regulatory infractions by paying $2 million in civil penalties. The settlement does not require Icahn or IEP to admit guilt or wrongdoing.

The $2 million SEC fine had costlier consequences for Icahn, today worth an estimated $5 billion, with IEP shares tumbling over 8% on the regulatory news. Icahn’s fortune was estimated north of $23 billion by Forbes in 2015.

Gaming History

In 2019, Icahn amassed a nearly 10% stake in the former Caesars — Caesars Entertainment Corporation — and pressured the company into giving him three board seats. Icahn and IEP’s board appointees encouraged the casino organization, which was financially distressed and nearly bankrupt, to pursue a strategic merger or takeover.

I believe the best path forward for Caesars requires a thorough strategic process to sell or merge the company,” Icahn said at the time.

The corporate raider or activist, depending on who is labeling Icahn, found a suitor in Eldorado Resorts.

Eldorado completed its $17.3 billion acquisition of Caesars in July 2020. Eldorado paid $8.5 billion for the organization and assumed $8.8 billion of the seller’s debt.

The merger resulted in the current Caesars Entertainment, as Eldorado folded on its name in favor of the more recognizable casino brand. It also resulted in a massive payday for Icahn.

Earlier Casino Plays

Icahn previously made a hefty sum by owning Tropicana Entertainment.

After buying the casino company in bankruptcy for $200 million in 2010, IEP invested in renovating the company’s casinos and improving their operations. In April 2018, IEP sold Tropicana’s six casinos to Gaming and Leisure Properties for $1.21 billion, with the real estate investment trust agreeing to lease the operations of the acquired resorts to Eldorado.

Icahn hasn’t always invested in improving an acquired casino’s operations or facilities.

Amid the 2008 Great Recession, Icahn in 2010 bought the unfinished Fontainebleau Las Vegas in bankruptcy for $156 million. He never resumed construction of the nearly finished towering blue structure, which for years sat as a reminder of the devastating impact the recession had on Las Vegas.

In August 2017, Icahn sold the Fontainebleau in the same, or possibly even worse shape than when he bought it, for $600 million.

Icahn also bought Trump Entertainment Resorts in bankruptcy in 2016. He would eventually shutter the company’s casinos that were developed by former President Donald Trump. But unlike his other gaming plays, Icahn’s bet on Trump Entertainment was a loser.

Icahn sold the Trump Taj Mahal for just $50 million to Hard Rock International in March 2017. The long-closed Trump Plaza was imploded in February 2021.