Prime Day is always a big shopping event for Amazon (NASDAQ: AMZN), as the e-commerce giant lures shoppers to its site with deals. This year’s shopping event set a record for the company, with Adobe Analytics projecting shoppers spent approximately $14.2 billion on its platform during the two-day event.

Let’s look at the strong showing Amazon is seeing with Prime Day and what that could mean for the stock.

A record Prime Day

Approximately $14.2 billion in sales on Amazon’s platform would be about an 11% increase from 2023 levels, according to Adobe. That would represent a nice acceleration from the 6% growth Adobe estimated that consumers spent on its platform during its Prime Day event last year. Amazon does not disclose its actual Prime Day event sales, but did say it was a record.

Spending per order, meanwhile, saw a nice uptick, according to Numerator. It noted that the average order on Amazon was $57.97 compared to $54.05 last year. That’s an over 7% increase.

Back-to-school spending was particularly strong, up 216% according to Adobe. This is good news for Amazon and other retailers, as it shows the consumer is back. Outside of Christmas and the winter holidays, back-to-school shopping is one of the most important shopping periods for retailers.

The Amazon Prime Day shopping event is estimated to represent about 1% to 2% of the company’s global sales, according CFRA Research.

For its first quarter, Amazon saw a 7% increase in its online store sales to $54.7 billion. Meanwhile, it forecast overall revenue to grow by 7% to 11% in the second quarter. As such, a successful Prime Day, which is part of its third quarter, could help the company see accelerating growth in the back half of the year, if this is a sign of a strengthening consumer.

It is notable that the other parts of Amazon’s business outside of online sales are growing more quickly. For example, AWS revenue grew 17% in Q1 to $25 billion, while advertising services revenue jumped 24% to $11.8 billion and third-party services climbed 16% to $11.8 billion.

Is now a good opportunity to buy the stock?

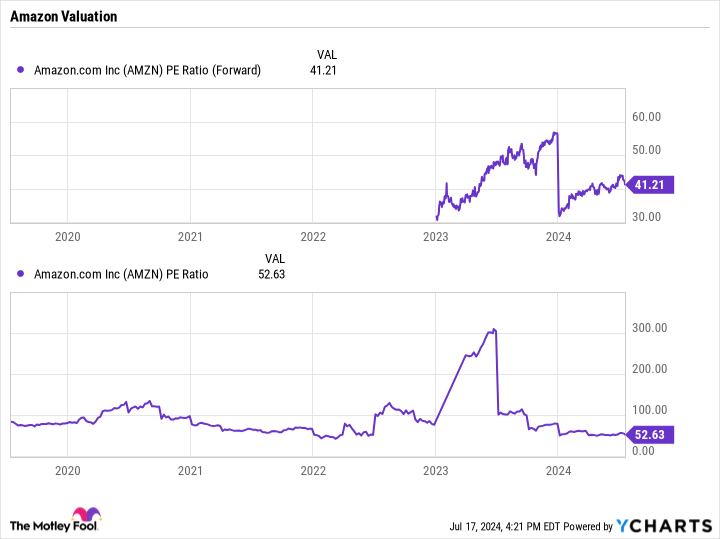

Amazon trades at a forward price-to-earnings (P/E) ratio of around 41 times. While not cheap per say, it is below where the stock has typically traded at over the past few years.

At the same time, Amazon has not seen a strengthening consumer environment in quite some time. Record Amazon Prime Day sales don’t necessarily by themselves mean the consumer is strengthening, but year-over-year retail sales for June were the strongest since last fall, according to the National Retail Federation. Meanwhile, containership port volumes saw their biggest jump in two years in May, which is an indication that retailers are expecting sales to increase.

A strengthening consumer environment combined with the opportunity the company has with artificial intelligence (AI) within its Amazon Web Services cloud computing business and other businesses should bode well both for continued and potentially accelerating growth for Amazon. If this proves to be the case, and there are certainly hints that this is occurring, then now looks like it could be a very good time to buy the stock before other investors catch on.

Meanwhile, Amazon has proven to be willing to make big bets and spend money to come out on top. With AI being a huge opportunity and the company still the dominant player in e-commerce, the stock is a solid option for investors over the long term.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe and Amazon. The Motley Fool has a disclosure policy.

As Amazon Prime Day Hits Records, Is Now a Great Opportunity to Buy Amazon Stock? was originally published by The Motley Fool