In May 2017, Nvidia (NASDAQ: NVDA) co-founder and CEO Jensen Huang was interviewed in the MIT Technology Review when he said, “Software is eating the world, but AI is going to eat software.” This week, Nvidia briefly became the most valuable company in the world, with a market capitalization of over $3.3 trillion, before closing Friday just a little behind Microsoft and Apple. In short, the artificial intelligence (AI) revolution has produced eye-popping financial results for the business, igniting incredible gains for the stock.

Nvidia is undeniably an AI juggernaut. Huang was ahead of the trend, developing both hardware and software for AI long before there was strong demand. In other words, Nvidia was ready for AI well before its time in the spotlight.

That time finally came once OpenAI launched its ChatGPT product in late 2022. Generative AI applications were suddenly at the forefront of everyone’s imagination, and businesses quickly felt the need to do something or risk getting left behind.

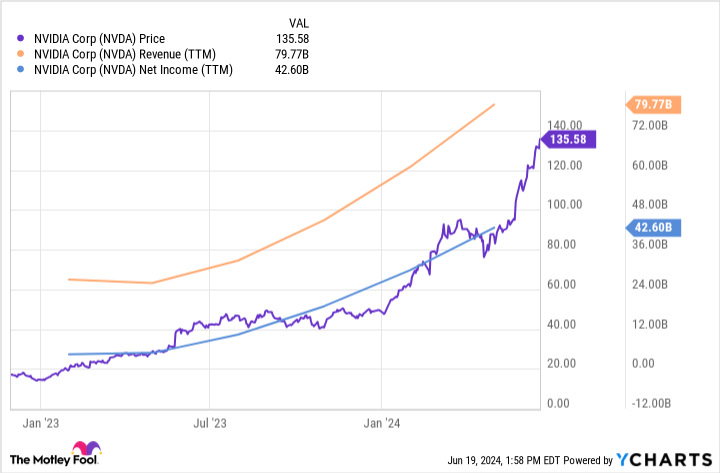

The chart below shows that since the launch of ChatGPT, Nvidia’s revenue and net income have skyrocketed — to say nothing of its stock price.

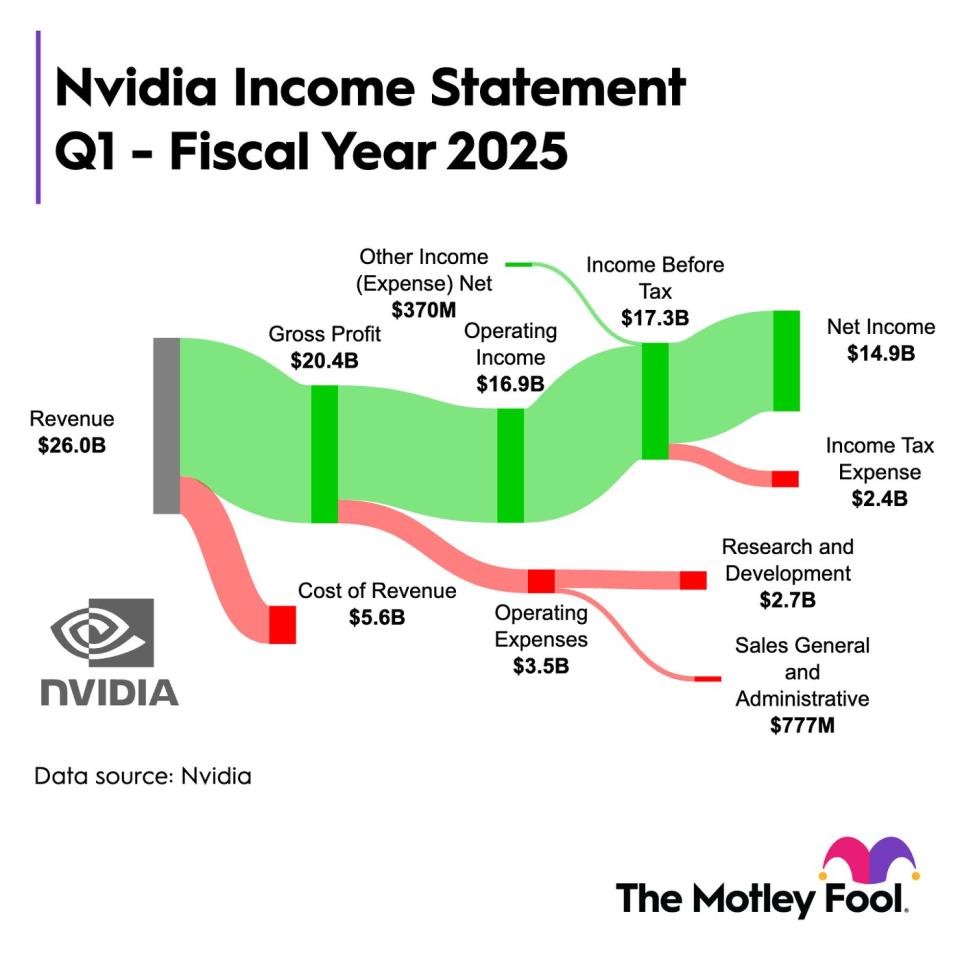

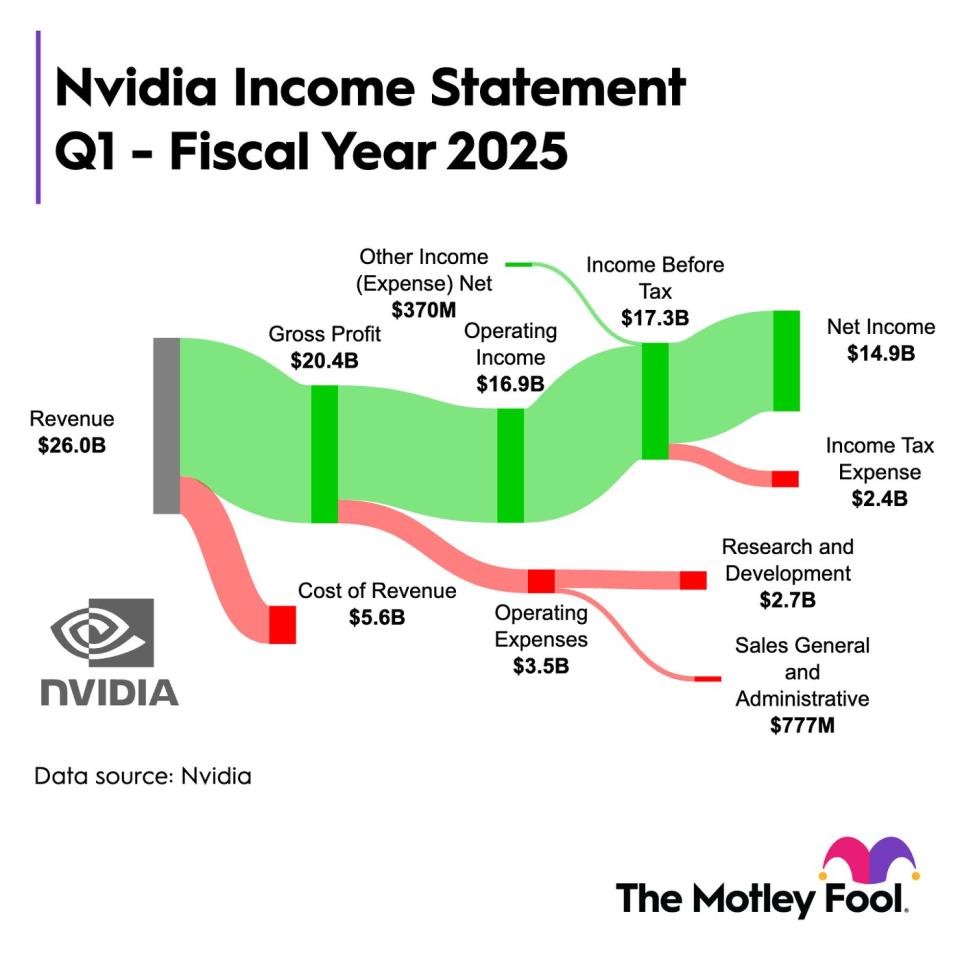

To emphasize what’s important here, Nvidia had a net income margin of 57% during its fiscal 2025 first quarter (ended in April). That’s astronomically high for any business in any industry, let alone a company that generates substantial revenue from selling semiconductor hardware.

The chart below further illustrates just how high Nvidia’s profits are (in green):

Therefore, it’s evident that Nvidia has a competitive advantage, giving it pricing power. Its customers are willing to pay exorbitant prices because they simply must get their hands on its chips to stay relevant in the AI race.

In light of this situation, here are some things investors should think about.

Is the advantage durable?

There’s a difference between a competitive advantage and a competitive moat. When a business has an advantage, it can profit more than its competitors. But unless it also has a moat, the benefit could be short-lived.

On one hand, it does seem Nvidia has something special. Its graphics processing units (GPUs) are essential to powering and training AI models. Companies such as Meta Platforms and Microsoft are among Nvidia’s largest customers. And even though the company didn’t directly confirm they are its biggest customers, Nvidia’s top-two customers accounted for 13% and 11% of Q1 revenue of $26 billion.

These are some of the most important tech companies in the world. If they’re willing to spend this much on Nvidia’s products, then those products must be high-performance and high-quality.

On the other hand, Nvidia’s current pricing power might have more to do with supply and demand than product quality. After all, Nvidia is a first mover here so it’s been able to supply GPUs better than most as demand skyrocketed. But the biggest tech companies have deep pockets and are developing their own solutions.

Investors, therefore, need to answer two questions. First, will demand for AI hardware and software continue to grow? And second, will Nvidia be able to maintain its dominant position in the industry?

If overall demand drops or if other companies take market share, then Nvidia could lose some of its valuable pricing power. It wouldn’t become irrelevant, but those astronomical profit margins could normalize.

Is software the secret sauce here?

As mentioned, Nvidia generates substantial revenue from hardware, although the exact number is opaque — management breaks revenue out by end market, not by source. However, the company strategically prioritizes software too, which could also be driving results under the hood.

For one example, Nvidia offers a software language called CUDA (Compute Unified Device Architecture), and in 2023, 4.7 million developers were using it. This software framework unlocks the true power of Nvidia’s GPUs. If a business is using Nvidia’s hardware and wants to do things such as machine learning or data mining, CUDA is often necessary to that effort.

This could provide a degree of incentive to choose Nvidia GPUs over similar products from competitors. If developers are accustomed to Nvidia’s software offerings and frameworks, they may be reluctant to switch and learn new systems. This could support continued demand for Nvidia because it’s the ecosystem so many developers are used to.

Combine this edge in software and services with the top-tier performance of its GPUs, and you get a fuller picture of how Nvidia has leveraged its leadership in AI to become the world’s most valuable company.

As long as this is the reality, Nvidia stock should continue to outperform. And the longer this is true, the more likely its advantage is actually a moat. However, if its current advantage is only temporary, then its profits could come back down to earth, much to the surprise of many of today’s investors. This is why it’s so important for Nvidia’s shareholders and prospective investors to form an opinion on this subject.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Artificial Intelligence (AI) Juggernaut Nvidia Is One of the World’s Most Valuable Companies. Here’s What Investors Should Know. was originally published by The Motley Fool