Apple (NASDAQ: AAPL) and Oracle (NYSE: ORCL) blasted to all-time highs on Wednesday.

Apple is up over 14% in the last month — the recent rally primarily fueled by a positive response to its annual Worldwide Developers Conference. Apple is integrating artificial intelligence (AI) across several key product categories. Meanwhile, Oracle is up 19% in the last month, getting an additional boost from its recent financial results and guidance.

Since Oracle is listed on the New York Stock Exchange, you won’t find it in the Nasdaq Composite or Nasdaq-focused exchange-traded funds (ETFs). But you will find both Apple and Oracle in the Vanguard Total Stock Market ETF (NYSEMKT: VTI), the Vanguard S&P 500 ETF (NYSEMKT: VOO), and the Vanguard Information Technology ETF (NYSEMKT: VGT). Here’s a primer on each fund, why all three funds just hit all-time highs, and the best one to buy now.

Diversified exposure

The Total Stock Market ETF and S&P 500 ETF are the two largest Vanguard ETFs — both featuring over $1 trillion in net assets. Both funds have 0.03% expense ratios — or $3 in annual fees per $10,000 invested. The low cost and simplicity of these funds make them great choices for folks looking for a passive yet effective way to mirror the broader market’s performance.

The Vanguard Total Stock Market ETF has 3,719 holdings compared to 504 holdings in the Vanguard S&P 500 ETF. However, the largest companies are so valuable that the S&P 500 represents approximately 80% of the market cap of the U.S. stock market. This dynamic makes the performance of the two ETFs very similar.

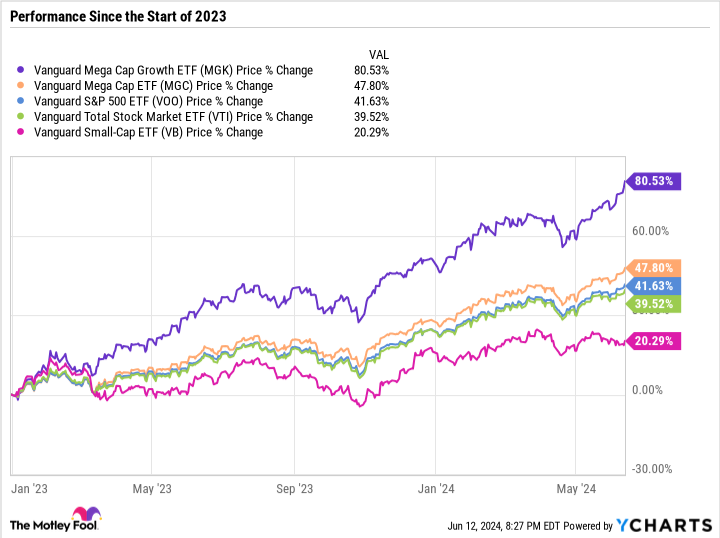

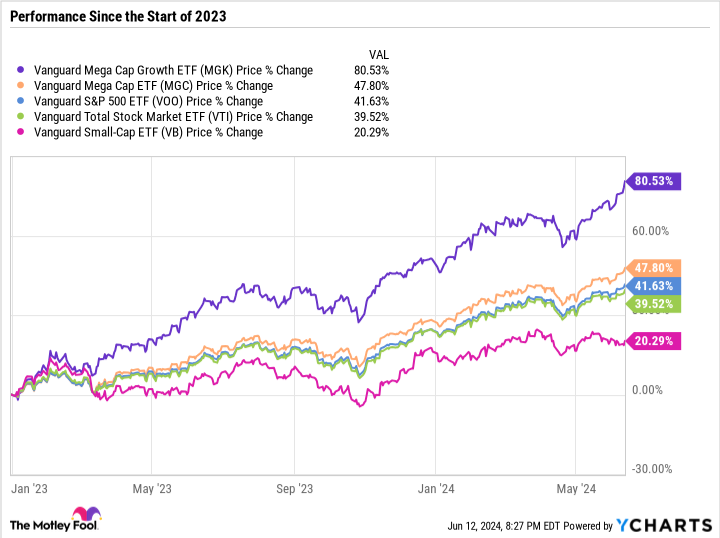

The Vanguard S&P 500 ETF will generally do better than the Vanguard Total Stock Market ETF if mega-cap and large-cap stocks are outperforming mid-cap and small-cap stocks. The last 18 months or so is a great example of what you can expect when megacaps are leading the market higher.

As you can see in the chart, mega-cap growth has crushed the S&P 500, while mega-cap stocks have done well, while mid and small caps have done poorly. But even under those circumstances, the Vanguard S&P 500 ETF has only outperformed the Vanguard Total Stock Market ETF by a couple of percentage points.

So despite the significant difference in quantity of holdings between the two funds, both perform practically the same because the S&P 500 makes up such a large share of the broader market.

An inexpensive way to invest in the hottest stock market sector

The simplest way to invest in companies like Apple and Oracle without racking up large fees is through the Vanguard Information Technology ETF. It has a higher expense ratio at 0.1% compared to 0.03% for the larger Vanguard funds. But that’s only a $7 difference per $10,000 invested.

The tech sector is chock-full of high-octane growth stocks — including the three most valuable companies in the world — Apple, Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA). But it also includes more pick-and-shovel plays — like materials and component suppliers.

Still, the fund is basically going to boom or bust according to the performance of its three largest holdings and the two largest industries, semiconductors and software.

The semiconductor industry has been a huge winner from the AI-induced run-up in the market. The two best examples are Nvidia, which became the third company valued at over $3 trillion, and Broadcom, which surpassed $800 billion in market cap on Friday after blowing earnings expectations out of the water.

With the tech sector contributing 30.6% of the S&P 500 and the semiconductor industry comprising 27.6% of the tech sector, some simple math tells us that the industry now makes up a whopping 8.5% or so of the entire S&P 500. For context, that means the semiconductor industry has about the same weighting as the entire industrial sector or energy, utilities, and materials combined.

The tech sector includes companies that provide the computing power needed to run complex AI models, as well as companies that are investing in ways to apply AI for enterprises and consumers. For that reason, it stands out as the best sector to invest in if you want exposure to the growing trend.

A well-deserved premium valuation

The danger of buying red-hot tech stocks right now is valuation. The Vanguard Information Technology ETF has a 42.6 price-to-earnings (P/E) ratio. Earnings growth has been strong, but many of the gains have been due to a valuation expansion.

Apple’s P/E ratio is up to 33.2 compared to its three-year median of 28.1. Microsoft has a 38.2 P/E, while its three-year median is 33.3. Oracle’s P/E is 37 compared to a three-year median of 30.2. The list goes on and on.

Over the long term, tech companies are perfectly positioned to deploy capital toward high-margin opportunities that lead to earnings growth. The sector is admittedly a little overextended at this point from a valuation standpoint, but it still has what it takes to be a good investment. And for that reason, the Vanguard Information Technology ETF is a better buy than the Vanguard S&P 500 ETF or the Vanguard Total Stock Market ETF if you have a high risk tolerance.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Oracle, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard Index Funds-Vanguard Total Stock Market ETF, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Apple and Oracle Helped Propel These 3 Vanguard ETFs to All-Time Highs. Here’s My Favorite to Buy Now. was originally published by The Motley Fool