Nvidia (NASDAQ: NVDA) has probably been the most watched stock on the planet over the past several months. This is because the company dominates the artificial intelligence (AI) chip market, and its soaring revenue has prompted the stock to skyrocket. In the first half, the shares soared more than 150% — and that’s after already gaining more than 1,300% in the previous five years.

In fact, this momentum pushed Nvidia stock past the threshold of $1,000, a level that may be a psychological barrier for some investors — and in other cases makes it difficult for small investors to buy without relying on fractional shares. So Nvidia launched a stock split recently to bring down the price of each individual share. Investors welcomed the news, and the stock rallied nearly 30% from the split announcement through the actual operation.

Now, though, the big question is whether Nvidia’s momentum will continue post-split and whether this top chip designer will soar in the second half. Let’s look to history for some answers.

Looking at historical patterns

First, it’s important to note that just because a certain pattern occurred in the past doesn’t guarantee the same pattern will continue in the future. So, any conclusions we draw may guide us — but they aren’t set in stone. The market or a particular stock may surprise us.

That said, patterns do replicate frequently enough to make them worth our consideration. They may offer us an idea of what generally happens after a certain event, making us aware of likely possibilities.

Let’s move on to the idea of stock splits and what history shows. A stock split, through the issuance of new shares to current holders, lowers the price of each individual share — but without changing the market value of the company or the valuation of the stock. So, the operation hasn’t changed anything fundamental about the particular company or stock.

But the split accomplishes one major thing: It opens the investment opportunity up to a broader range of investors. This is positive for you and me because it makes it easier for us to invest in a company like Nvidia, and it’s positive for the company because it offers it a whole new audience of potential investors. So it’s a win-win situation. Nvidia’s 10-for-1 stock split brought the stock price down from more than $1,000 to about $125.

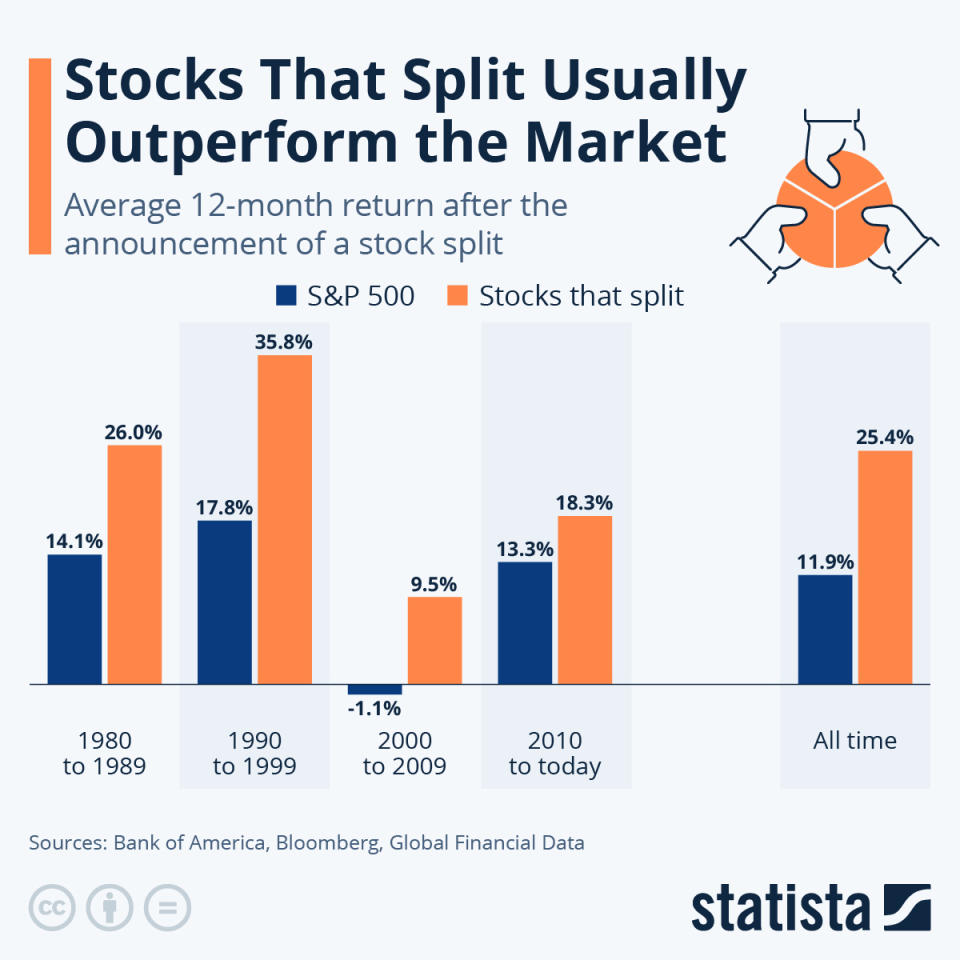

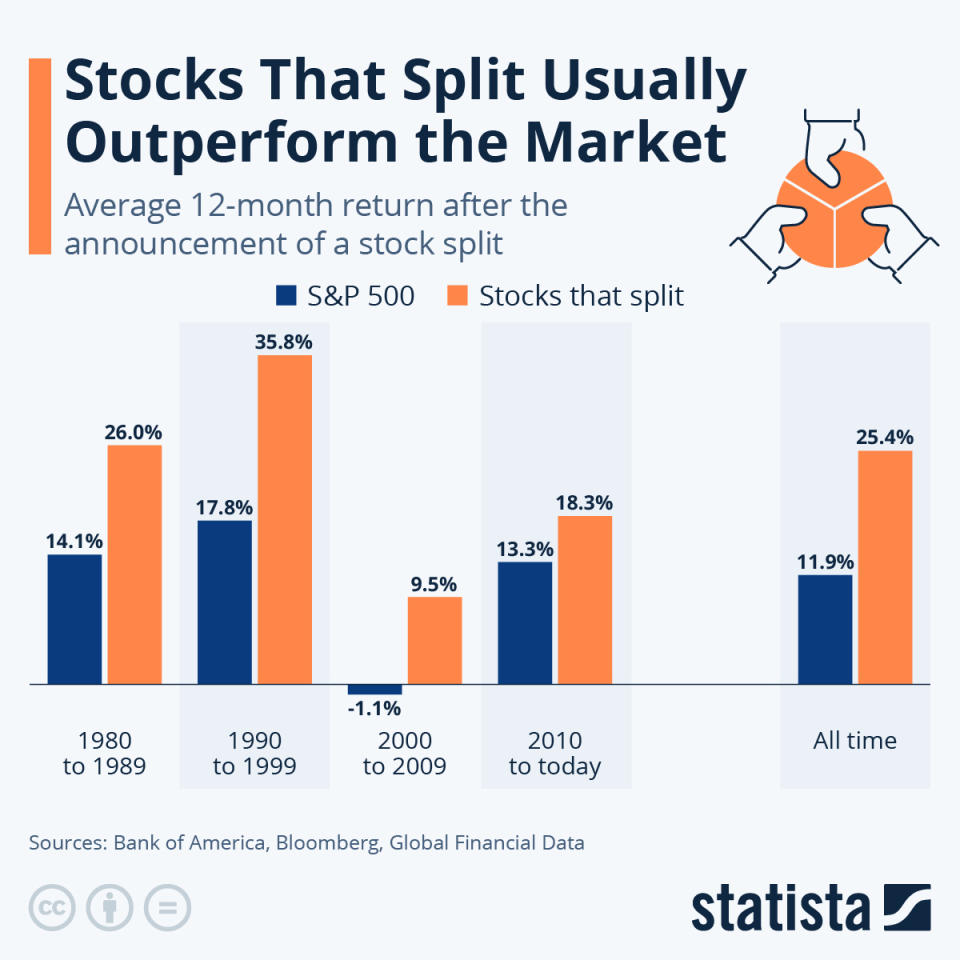

Stock splits in and of themselves, since they’re just mechanical operations, aren’t catalysts for stock performance — you wouldn’t buy a stock just because the company launched a split. But, as you can see in the chart, below, history shows that stock split players tend to outperform the S&P 500 in the 12 months following the stock split announcement.

The chart shows that stock split companies have generated an average total return of more than 25% in that 12-month period. That’s compared to less than 12% for the S&P 500 as a whole. This is based on Bank of America‘s Research Investment Committee data from 1980 through today.

Nvidia’s past stock splits

Now we can dig deeper by looking at Nvidia itself after its past two stock splits, in 2007 and 2021. After both, the stock declined in the 12 months that followed — but first, the shares advanced in the two to five months after the operation. Nvidia stock climbed more than 60% in the five months following the 2021 split and added about 17% in the six-week period following the 2007 split.

So, what does all of this tell us about what may happen today? It’s important to keep in mind that Nvidia’s business has greatly evolved since the past stock splits. Then, it mainly served the video gaming industry and progressively was moving into other areas, such as AI. Today, the high-growth field of AI is the company’s main business, making the stock significantly more attractive to investors. So Nvidia may have stronger momentum today than it did after previous splits — and that might make a lasting rally possible.

This can happen if Nvidia continues to report impressive earnings growth and deliver on product launch goals. And things look promising. Nvidia has reported quarter after quarter of record revenue and says demand for its soon-to-launch Blackwell architecture and chip surpasses supply. And speaking of Blackwell, this launch, too, could be a positive catalyst for the stock.

All of this means it’s very possible Nvidia stock will soar in the second half, thanks to the company’s leadership in a high-growth market and solid revenue prospects. And the best news is this: Even if history is wrong and Nvidia doesn’t rally in the coming months, this top stock still has what it takes to deliver big returns to investors over the long term.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $774,526!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 24, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

After Nvidia’s Stock Split and 150% First-Half Gain, Will It Soar in the Second Half? Here’s What History Says. was originally published by The Motley Fool