There’s increasing uncertainty these days. The economy is starting to show some signs of slowing, and the possibility of an escalating conflict in the Middle East is creating anxiety. On top of that is the upcoming presidential election.

All this uncertainty has investors rattled, with the market recently having its worst day since early last year.

These factors might have you fearing that another bear market could be around the corner. One potential way to help shelter your portfolio against a future market storm is to insulate it with high-quality, high-yielding dividend stocks. WEC Energy (NYSE: WEC), Enbridge (NYSE: ENB), and Northwest Natural Holding (NYSE: NWN) stand out to these Motley Fool contributors as great safe havens.

A boring utility with impressive dividend growth

Reuben Gregg Brewer (WEC Energy): One of the most attractive things about WEC Energy is that it flies under the radar. As a fairly traditional regulated electric and natural gas utility serving around 4.7 million customers in parts of Wisconsin, Illinois, Michigan, and Minnesota, its business is very straightforward.

And because of the importance of energy to modern life (and the monopoly WEC has been granted in the regions it serves), its customers are going to keep using power no matter what the market is doing.

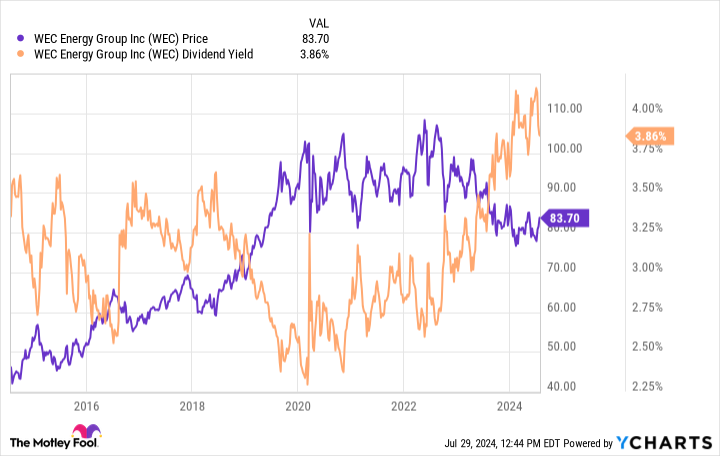

Sure, interest rates are high, and that’s going to be a headwind for WEC Energy, which like most utilities makes heavy use of debt to fund its business. And it is dealing with an adverse regulatory ruling in Illinois with regard to natural gas. But these problems have depressed the share price and increased the attractiveness of the stock for income investors, given that it now yields a historically high 4% or so.

That dividend, meanwhile, is backed by 21 consecutive annual increases. The average yearly increase over the past decade was roughly 7%, which is pretty attractive for a utility. Meanwhile, management expects earnings growth to fall between 6.5% and 7% a year for the foreseeable future.

If history is any guide, the dividend will follow earnings higher. And given the regulated nature of the business, the good news should continue to flow even through a bear market. But jump quickly or you might miss the opportunity here.

A model of stability and durability

Matt DiLallo (Enbridge): Enbridge has one of the lowest-risk business models in the energy sector. The Canadian pipeline and utility operator gets 98% of its earnings from stable cost-of-service or contracted assets, like oil and gas pipelines, natural gas utilities, and renewable energy facilities. These assets produce such predictable cash flow that Enbridge has achieved its financial guidance for 18 straight years.

The company took a notable step to further enhance the stability of its cash flow over the past year by acquiring three natural gas utilities. When it sealed the deal in late 2023, CEO Greg Ebel said, “These acquisitions further diversify our business, enhance the stable cash flow profile of our assets, and strengthen our long-term dividend growth profile.”

The transaction will increase its earnings from stable natural gas utilities from 12% to 22% of its total. The company partly funded that deal by selling Aux Sable, which operates extraction and fractionation facilities for natural gas liquids.

Enbridge also has a strong investment-grade balance sheet and a conservative dividend payout ratio. It has billions of dollars in annual investment capacity after paying its dividend (which yields an attractive 7%).

That gives it the flexibility to fund its roughly $18 billion backlog of secured capital projects. It also has the capacity to make opportunistic acquisitions and approve more expansion projects.

The company’s secured growth drivers and initiatives to reduce costs and optimize its assets should grow its cash flow per share by around 3% annually through 2026 and 5% per year after that. Its visible earnings growth and strong balance sheet suggest it should have no trouble increasing its dividend, which it has done for 29 straight years.

That high-yielding and steadily rising payout supplies a very strong base return, providing investors with some shelter amid a future financial storm.

68 consecutive years of dividend increases, and counting

Neha Chamaria (Northwest Natural Holding): If you haven’t heard about Northwest Natural, the company’s dividend track record will stun you. Utilities often pay regular and stable dividends, and Northwest Natural is no different.

What sets it apart, though, is that Northwest Natural has increased its dividend every year for the last 68 consecutive years. That’s one of the longest streaks among Dividend Kings.

Northwest Natural provides natural gas and water services through its subsidiaries, including NW Natural, NW Natural Water, and NW Natural Renewables.

NW Natural provides natural gas to nearly two million people in Oregon and southwest Washington State, while NW Natural Water serves around 180,000 people. As is typical with regulated utilities, Northwest Natural can earn and generate stable earnings and cash flows, which is why it not only can afford to pay a regular dividend but also grow it with time.

It’s a great dividend stock for several reasons. The utility expects to invest $1.4 billion to $1.6 billion in its natural gas business over the next five years, which could boost its rate base by 5% to 7%.

Management believes this investment, combined with its spending on water infrastructure, could boost its earnings per share by a compound annual growth rate of 4% to 6% between 2022 and 2027. Since the company prioritizes dividend growth, earnings growth should mean bigger dividends for shareholders year after year.

Its 68-year streak, of course, is the biggest testimony to how reliable Northwest Natural’s dividends are. With its high yield of 4.8%, this is the kind of stock that will let you sleep even during bear markets.

Should you invest $1,000 in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Matt DiLallo has positions in Enbridge. Neha Chamaria has no position in any of the stocks mentioned. Reuben Gregg Brewer has positions in Enbridge and WEC Energy Group. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.

Afraid of a Bear Market? 3 High-Yield Stocks That Could Be Your Safe Haven in a Storm. was originally published by The Motley Fool