While other social platforms continue to push random AI features that no one asked for, and face more questions over political content, Pinterest continues to go about its business, steadily increasing its active users and revenue, as per its latest performance update.

Though within that, there are some points of concern, which could temper enthusiasm for Pinterest’s overall potential.

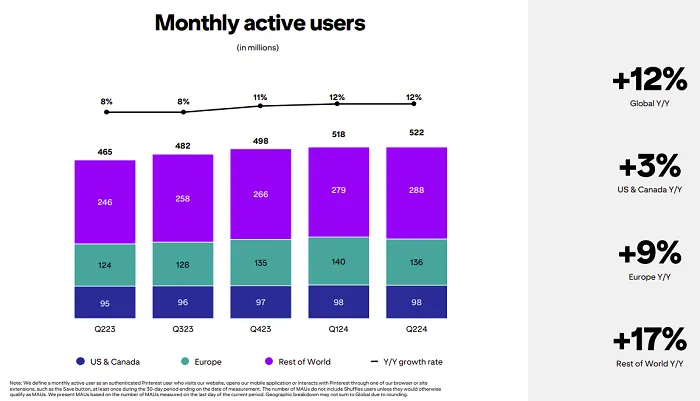

First off, on users, Pinterest added 4 million more monthly active users in Q2, taking it up to 522 million MAU.

Pinterest’s ongoing user growth is a good sign for future opportunities, though it has lost momentum, adding significantly fewer users in this quarter than it has in the previous four.

As you can see in the above graphs, Pinterest had added an average of 17.6 million new users per quarter over the past year, but that’s dropped to 4 million this time around. Which still equates to double-digit growth year-over-year, but it’s also worth noting that the majority of its growth is still coming from the “Rest of World” category, while it’s stagnating, and even losing users in its core revenue regions.

Which is a concern when you also take into account these charts:

Pinterest is reliant on the U.S. and Europe to power is revenue intake, as it continues to build its ad business in other markets. And revenue for both of these regions has grown, but the fact that usage is declining (on aggregate) in these sectors will not reassure market analysts.

But again, Pinterest has grown its ad revenue, bringing in $854 million for the period.

That suggests that Pinterest’s recent marketing pushes are having some impact, and that more brands are at least trying out Pin ads, especially in North America, which saw a 13% jump in Q2 revenue intake.

But that also comes at a higher cost:

As you can see in these graphs, Pinterest’s Sales and Marketing costs continue to rise, as does its investment in Research and Development.

As noted, Pinterest is making a bigger effort to win over potential ad partners with dedicated promotional campaigns, while it’s also investing in AI technology of its own, though more specifically aligned with the app’s key use case.

Both are necessary investments, but again, it’s another indicator that doesn’t go in Pinterest’s favor as a longer-term bet. Pinterest has also forecast that its operating expenses will continue to rise in line with these efforts.

So, is this a good report for Pinterest?

Well, overall, the core result is positive, in that it’s been able to drive higher revenue from fewer users in its key markets. But the fact that it has fewer users in these areas is a concern, while its overall growth has also eased back, when it did seem to have more significant growth momentum.

I don’t think the platform’s investment in growth is as big of a concern overall, given the significant requirements of AI development, and the fact that Pinterest’s systems continue to improve in matching people to the right products in the app. And the signs here would suggest that these improvements are driving results for brands, but the concern is that if Pinterest is losing key audience share, that means that it has to show more ads to fewer people, which could eventually sour them on the user experience.

But maybe, if Pinterest’s promotions are increasingly relevant, that’s not such a big concern, and really, Pinterest’s overall growth in recent times has all come from lower revenue markets anyway, so overall, slower growth figures, overall, are not a major concern.

But a decline in Europe is bad, and if Pinterest can’t add more U.S. users next quarter, despite its marketing pushes, that could start to look like a cap on its growth, and a limit on its revenue potential.

So right now, it’s a bit of a red flag, but the opportunity for Pinterest remains, if it can get all of its metrics moving in the right direction at once.