(Bloomberg) — US stock futures pointed to gains on bets for a second Donald Trump presidency and traders’ anticipation of US retail sales data later in the day that would influence the Federal Reserve’s rate cut decision.

Most Read from Bloomberg

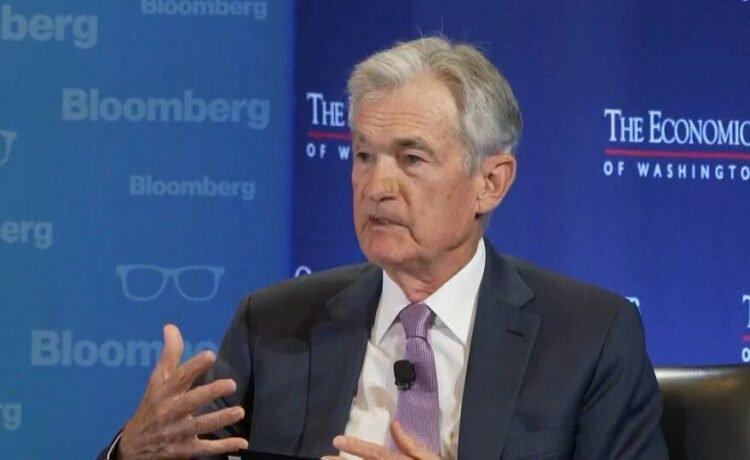

S&P 500 contracts rose 0.1% as traders priced a greater chance of a Trump win after he survived an assassination attempt. Additionally, Fed Chair Jerome Powell’s comment that inflation is heading toward the central bank’s 2% goal boosted sentiment. European futures traded lower ahead of the European Central Bank’s rate decision on Thursday.

The dollar strengthened against most of its Group-of-10 peers. The yen declined against the greenback on wagers that the Japanese currency will remain weak during Trump’s second term. US 10-year bond yields edged lower ahead of the nation’s retail sales.

“Current expectations are pointing to a more subdued state for US consumers, with June retail sales to turn in flat month-on-month, down from previous 0.1%,” wrote Jun Rong Yeap, a market strategist at IG Asia Pte. “That may continue to reinforce market expectations for a September rate cut from the Fed.”

Meanwhile, the MSCI AC Asia Pacific index fell 0.3%, set for its third day of losses. Stocks in Hong Kong declined the most in the region, while some stocks in China traded lower as bets on a second term for Trump following his running mate announcement triggered further trade and geopolitical concerns in the region. Shares in Japan rose, with exporters benefiting from the yen’s decline.

Investors have been allocating based on which countries will be seen as friends or foes by Trump, said Kyle Rodda, a senior analyst at Capital.com in Melbourne. “His view of the world is fairly zero sum” with Japan seen on friendly terms and China in the “bad books,” he said in an interview. “There’s definitely still that figurative pairs trade going on at the moment, which is long Japan and short China.”

The Dow Jones Industrial Average hit an all-time high as Trump named JD Vance as his running mate. Trump Media & Technology Group Corp. soared 31%. Trump’s rising odds of victory also boosted oil producers, gun makers and private prisons. His pro-cryptocurrency stance lifted the industry. Solar firms sank as Democrats are seen as more friendly toward the sector.

Vance is 39, nearly four decades younger than Trump, 78, offering a fresh voice to Republican efforts to bolster their appeal to the working-class workers who were once a bedrock of the Democratic party in battlegrounds such as Michigan, Wisconsin and Pennsylvania.

“The decision is crucial because one-third of US presidents throughout American history have previously occupied the position of vice president,” said Tom McLoughlin at UBS Global Wealth Management. “Moreover, in this instance, Trump’s decision effectively anoints Vance as his successor in terms of delivering a populist message to a younger generation of voters.”

Powell said in an interview that second-quarter economic data has provided policymakers greater confidence that inflation is heading down to the central bank’s 2% goal, possibly paving the way for near-term interest-rate cuts. He made clear he didn’t intend to send any specific message about the timing of rate reductions.

Back in Asia, outflows across US exchange-traded funds tracking Chinese equities persisted for a sixth-straight week, as weaker economic data and implications of a Trump victory spooked investors — even before Saturday’s assassination attempt. The world’s second largest economy recorded net outlfows of $229.4 million from this group of ETFs last week.

New tariffs of 60% on all Chinese exports to the US would more than halve China’s annual growth rate, according to new research from UBS Group AG, underscoring the risks for Beijing if Trump returns to the White House. Senator Vance of Ohio, Trump’s pick for his running mate, tells Fox News that China is the biggest threat to the US.

In corporate news, Energy Absolute Pcl shares tumbled as much as 30% in Thailand after the biodiesel product developer’s founder and chief executive quit over a fraud probe and its credit rating was slashed to junk.

In commodities, oil edged lower for a third day on concern over weak Chinese demand and the impact of a stronger dollar. Gold rose for a second day.

Key events this week:

-

US retail sales, Tuesday

-

Morgan Stanley, Bank of America earnings, Tuesday

-

Fed’s Adriana Kugler speaks, Tuesday

-

Eurozone CPI, Wednesday

-

US housing starts, industrial production, Wednesday

-

Fed Beige Book, Wednesday

-

Fed’s Thomas Barkin speaks, Wednesday

-

ECB rate decision, Thursday

-

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

-

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

-

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 2:34 p.m. Tokyo time

-

Nasdaq 100 futures rose 0.3%

-

Japan’s Topix rose 0.6%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hong Kong’s Hang Seng fell 1.3%

-

The Shanghai Composite was little changed

-

Euro Stoxx 50 futures fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.1%

-

The euro was little changed at $1.0889

-

The Japanese yen fell 0.4% to 158.75 per dollar

-

The offshore yuan was little changed at 7.2796 per dollar

Cryptocurrencies

-

Bitcoin rose 0.6% to $64,136.95

-

Ether rose 0.4% to $3,448.66

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.21%

-

Japan’s 10-year yield declined 2.5 basis points to 1.020%

-

Australia’s 10-year yield declined seven basis points to 4.25%

Commodities

-

West Texas Intermediate crude fell 0.4% to $81.56 a barrel

-

Spot gold rose 0.4% to $2,431.32 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess, Masaki Kondo and Ruth Carson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.