In a recent SF Fed Economic Letter, Sylvain Leduc, Huiyu Li, and Zheng Liu answered the question: “Are Markups Driving the Ups and Downs of Inflation?” If one defines inflation as a broad, economy-wide increase in prices, the answer is mostly “no”.

From the Letter’s conclusion:

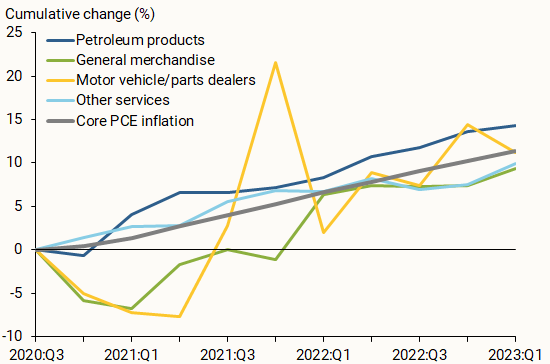

Using industry-level data, we show that markups did rise substantially in a few important sectors, such as motor vehicles and petroleum products. However, aggregate markups—the more relevant measure for overall inflation—have stayed essentially flat since the start of the recovery. As such, rising markups have not been a main driver of the recent surge and subsequent decline in inflation during the current recovery.

Two graphs are essential to seeing the difference between sector/industry specific prices and the general:

Note that a decomposition used in this post refers to the nonfarm corporate sector, and normalizes to nearly a year earlier than in Leduc-Li-Liu.