The epic rally in shares of tech behemoths is far outpacing their profits, and it could mean the S&P 500 is looking more vulnerable, according to Apollo Global Management chief economist Torsten Sløk.

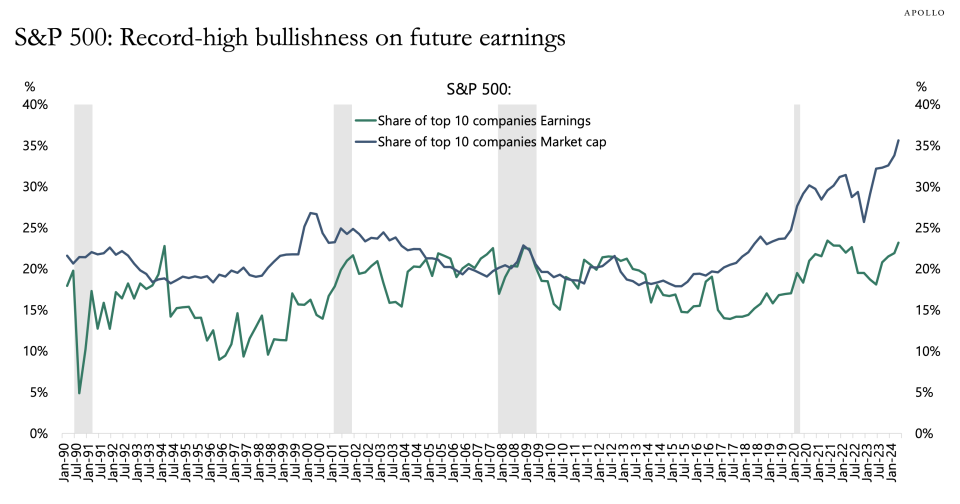

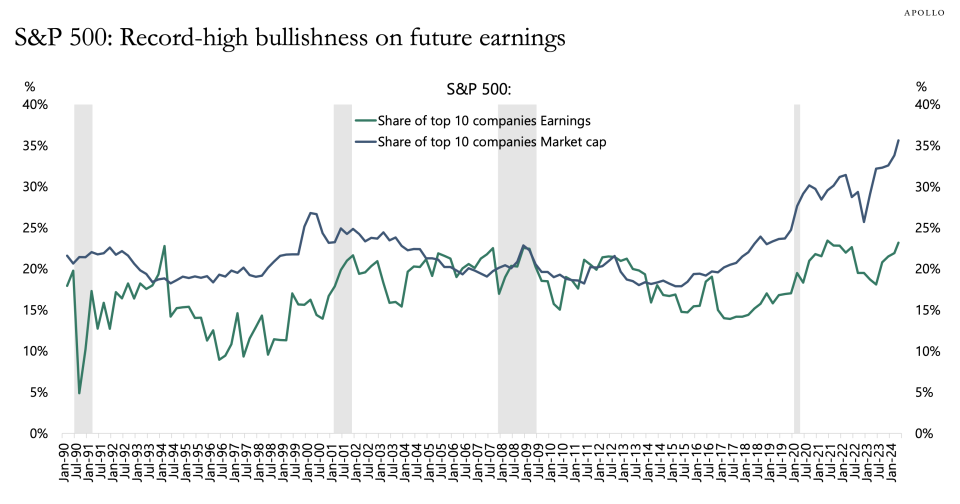

In a note on Sunday, he pointed out that the top 10 companies in the S&P 500 account for 35% of the index’s market value but only 23% of its earnings.

“This divergence has never been bigger, suggesting that the market is record bullish on future earnings for the top 10 companies in the index,” Sløk wrote. “In other words, the problem for the S&P 500 today is not only the high concentration but also the record-high bullishness on future earnings from a small group of companies.”

Because the S&P 500 is weighted by market cap, soaring share prices of Big Tech companies rushing into the AI boom has meant that recent gains are concentrated into just a handful of stocks, obscuring the relative mediocrity for rest of the index.

Before Nvidia began its selloff earlier this month, the AI chip leader accounted for more than a third of the S&P 500’s rally this year.

“Such a high concentration implies that if Nvidia continues to rise, then things are fine,” Sløk warned on June 12. “But if it starts to decline, then the S&P 500 will be hit hard.”

As market leadership becomes more concentrated, so are investors’ portfolios, especially as putting money in funds that track indexes becomes increasingly popular.

Bank of America analysts said in a recent note that the average large-cap fund has 33% of its portfolio in its top five holdings, up from just 26% in December 2022.

Similarly, the share of funds the have more than 40% of their portfolio in their top five holdings has jumped to 25% from less 5% in December 2022.

Meanwhile, Wall Street analysts have been bullish on the S&P 500 and are scrambling to raise their year-end targets. Even one of the biggest bears has surrendered and is now one of the most bullish analysts.

And Fundstrat Global Advisors cofounder Tom Lee recently said the S&P 500 could hit 15,000 by the end of the decade. He isn’t the only Wall Street bull making bold predictions.

Ed Yardeni has been pounding the table about another “Roaring Twenties” super-cycle and has said the S&P 500 would jump to 6,000 by next year. By the end of the decade, he said the stock index could reach 8,000.

This story was originally featured on Fortune.com