UiPath (NYSE: PATH) stock continues to trend in the wrong direction. The sudden resignation of CEO Rob Enslin sent shares plunging to all-time lows. So far, UiPath’s lead in robotics process automation (RPA) and its niche within artificial intelligence (AI) have failed to draw the interest of investors.

However, the robotics stock may have hit rock bottom, and if the company can regain its footing, it could find itself in a strong position to bounce back. Let’s see what could lie ahead for the struggling company.

What happened to UiPath?

The 2022 bear market never seemed to end for UiPath stock. Amid slowing growth and worries about competition, the stock missed last year’s bull market in AI stocks.

Moreover, a sudden CEO departure is never a good sign for the company but it may be especially troubling in this case. Enslin served as co-CEO of UiPath since April 2022 and only assumed full control when co-founder Daniel Dines left the role at the end of January.

Amid the departure, Dines has returned as CEO. Nonetheless, he will have to contend with continued struggles on the financial front. In the first quarter of fiscal 2025 (ended April 30), revenue of $335 million grew by 15% yearly, a slowdown from past years.

Unfortunately, operating expenses of $329 million remain elevated, coming in only $6 million under revenue. Consequently, the net loss for fiscal Q1 was $29 million, only a slight improvement over the $32 million loss in the year-ago quarter.

Why the news is not all bad

Despite the company’s challenges, Cathie Wood of Ark Invest, a longtime UiPath bull, added over 2 million shares to its various funds following the news. Other risk-tolerant investors may also have a unique buying opportunity here.

For one, it was $89 million in stock-based compensation, a non-cash expense, that led to UiPath’s net loss. In contrast, non-GAAP adjusted free cash flow is thriving, at $101 million for fiscal Q1. That is a 39% yearly increase and indicates that the company’s finances may be in better shape than the income statement might indicate.

Additionally, thanks to the dropping stock price, UiPath’s price-to-sales (P/S) ratio is 5. That is a record low for the stock and an opportunity to buy an AI stock at a low price.

Investors should also remember that UiPath remains a leader in robotic process automation. Unlike the hardware robots that most investors might imagine, RPA refers to software robots that impersonate human actions within software and digital systems.

UiPath stands out in this respect because it has built a 2.5 million-member developer community. Since the company fosters this community of developers using its ecosystem, it offers a strong incentive not to turn to competing RPA products.

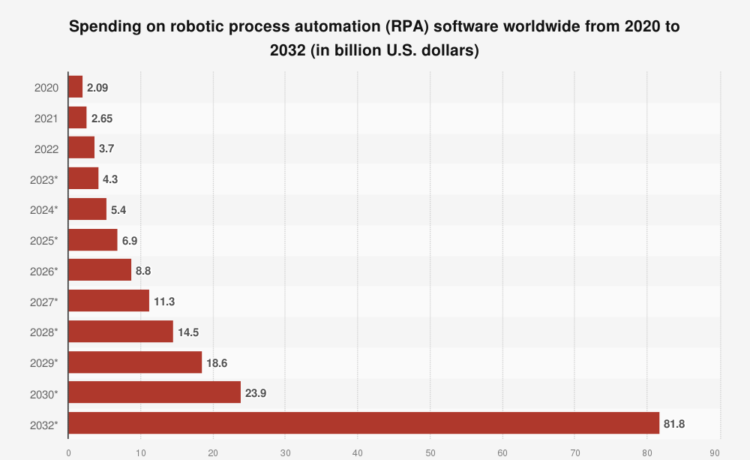

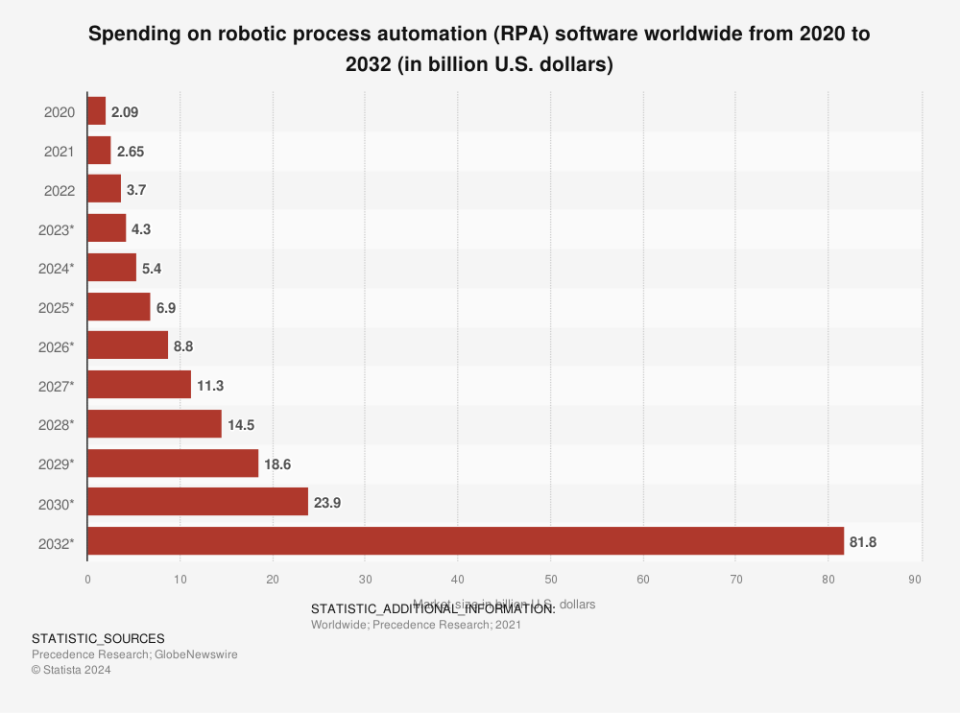

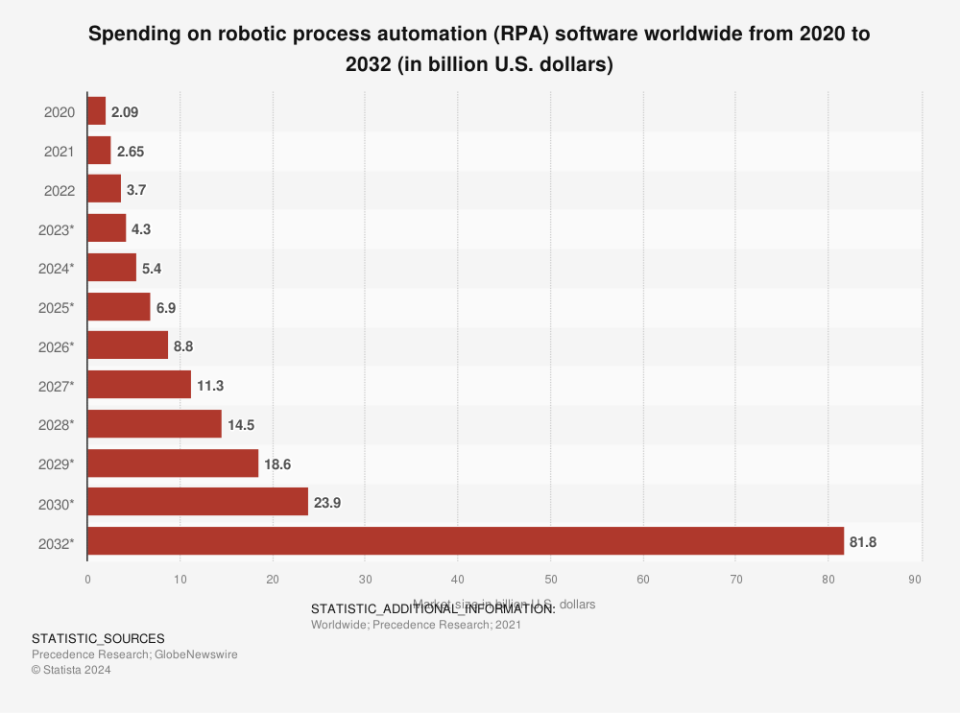

According to Gartner, this approach gave UiPath a 36% market share in its industry, up from 34% in 2022. Also, DataHorizzon Research forecasts the RPA market will grow at a 37% compound annual rate through 2032. Thus, despite a relatively small $6.8 billion market capitaization, UiPath remains a force in this industry, which should be tremendously positive for the stock in the long run.

Will UiPath stock stage a comeback?

Ultimately, a comeback is not guaranteed for UiPath, but it is a stock that more risk-tolerant investors should consider. The CEO’s departure is indeed a troubling sign, and the company’s stock has missed the AI boom over the last year.

However, UiPath is a leading company in the rapidly growing RPA industry. When considering the low P/S ratio, a large developer community, and the potential for more rapid growth, investors may later wish they had bought this stock at today’s prices.

Should you invest $1,000 in UiPath right now?

Before you buy stock in UiPath, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UiPath wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $794,196!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends UiPath. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

Will UiPath Stock Get Back on the Comeback Trail? was originally published by The Motley Fool