Fed Signals a Dramatic Shift in Policy—With Big Changes Coming for Interest Rates

On November 15, the Federal Reserve announced that they could raise interest rates as many as three times in 2022, signaling a dramatic shift in policy.

This is big news because at the start of the COVID-19 pandemic the Fed made two big moves to stimulate the economy. It lowered interest rates to near–zero and began a program of asset purchases—both of which worked as intended.

And now it appears we’ll be taking a step back from those two stimuli in 2022, which could have a significant impact on the housing market.

Why are these 2022 interest rate hikes important?

Ideally, the Fed would back off these economic stimuli slowly—first by tapering asset purchases gradually until they hit zero, and then by gradually raising interest rates by 0.25% at a time. This is what they did after the Great Recession to much success.

This is also a surprising move because, until recently, the Fed has signaled that it would end asset purchases completely in mid-2022 while raising rates only once toward the end of the year. But, the nation has been dealing with persistently high inflation, which hit 6.8% in November, per the Consumer Price Index—and this issue is what appears to have forced the central bank’s hand.

And, now the Fed intends to complete asset purchases by March 2022, with interest rates poised to climb shortly thereafter.

What does this mean for the economy?

For the economy as a whole, this is welcome news. The nation’s GDP is growing and unemployment is returning to pre-pandemic levels. Thus, there is little need for further economic stimulus. The biggest issue in the economy now is inflation, and raising the interest rates is the Fed’s best tool to fight inflation, as it reduces monetary supply.

Hopefully, this action by the Fed will reel in inflation as supply chain disruptions are sorted out. In turn, this will hopefully return the inflation rate to a level that’s closer to the Fed’s 2% target. That will likely take at least a year, though.

What does this mean for the housing market?

But even if this action is good for the economy as a whole, it will likely have significant implications for the housing market. When interest rates increase, it puts downward pressure on housing prices, because it makes the cost of a mortgage—or any other type of loan—more expensive.

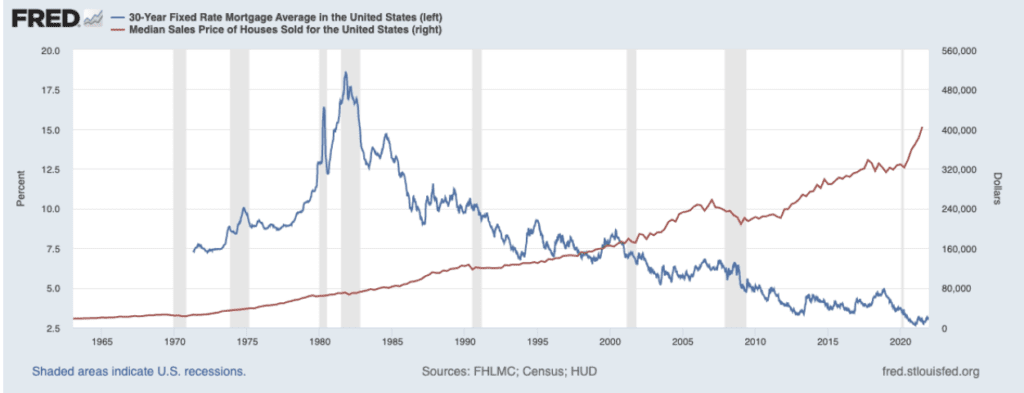

This is illustrated in the chart below. As depicted, there is a negative correlation between interest rates and housing prices. When one goes up, the other tends to go down—and vice versa.

But, the good news is that this is not always the case. There have been many times in U.S. history in which interest rates have increased and housing prices also increased in tandem.

This occurred most recently from 2013 to 2018, when there was a decent amount of volatility in interest rates. Still, the housing prices went up consistently before flattening in 2018, when interest rates hit post great recession highs.

That’s why it’s difficult to predict what will happen to the housing market as interest rates rise next year. When it comes to complex markets such as the housing market, there is no single indicator or factor that determines which way prices will move—and by how much they will shift. Rather, there are many forces at play—some of which are well understood and I will detail below – and others of which are unknown.

What will the housing market look like in 2022?

In my opinion, the biggest drivers of housing prices in 2022 will be interest rates, affordability, demand, supply, inventory, and inflation.

And, as stated earlier, the biggest forces in 2022 to exert downward pressure on the housing market will likely be interest rates and affordability. As interest rates rise, mortgages will get more expensive, which in turn hurts affordability.

Since we now know that the Fed will be raising interest rates in 2022, mortgage rates are extremely likely to rise as well—unless bond yields remain as low as they are, which seems unlikely. As mortgage rates increase, borrowers will not be able to afford to take loans as they are currently, and housing prices will feel the downward pressure as a result.

Home affordability has also been declining for months, as interest rates creep up slowly and home prices continue to hit new highs. However, with wage growth as high as it is in the U.S, some of the declining home affordability could be offset by these new interest rate hikes.

On the other side of the equation, there are forces that will likely exert upward pressure on housing prices. In my opinion, those are supply, demand, inventory, and inflation.

The housing supply in the United States is severely strained—and has been throughout the pandemic. It is estimated that the U.S. is short about 5 million-plus when it comes to the necessary housing stock. This is not the type of issue that can change overnight. It will likely take a decade or more for this dynamic to shift, and the constrained supply heavily contributes to the higher prices we’re seeing.

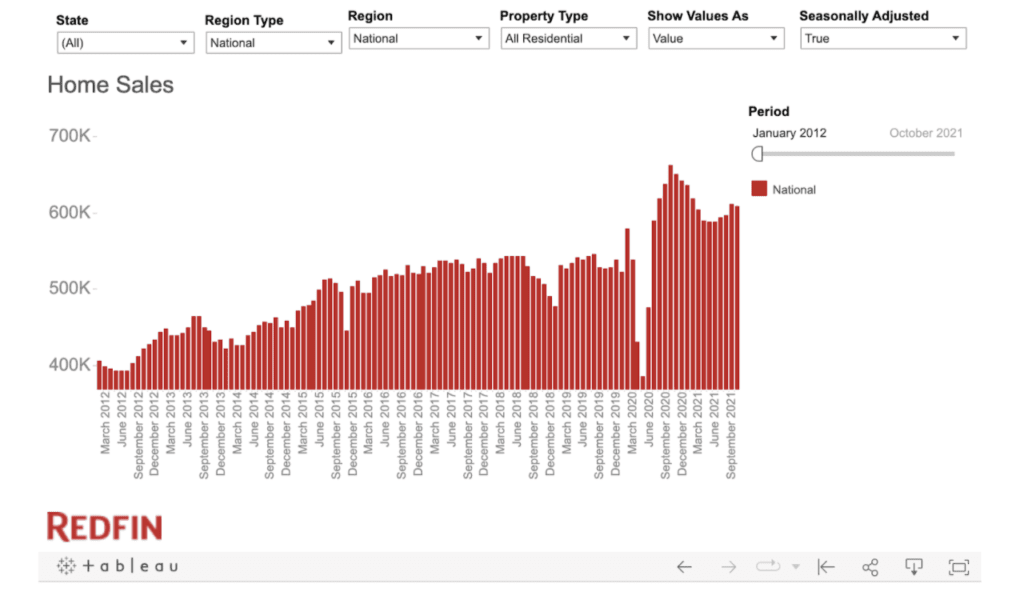

Demand is also strong by almost every measure. First and foremost, the total number of home sales is very healthy, according to Redfin. And, despite the very high home prices, people are still buying.

Information from the Mortgage Bankers Association, which maintains a survey of lenders that tracks purchase application data, backs up this buying trend.

“Housing demand remains strong as the year comes to an end amidst tight inventory and steep home-price growth,” Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting, said.

Still, that demand could decline as affordability declines, and is one of the variables I am most interested in monitoring over the next year.

Inventory, meanwhile, remains near all-time lows.

When inventory is this low, it indicates that the market is very competitive, which tends to lead to higher prices.

I don’t personally see a glut of inventory coming online anytime soon. And for those who think a foreclosure boom is going to happen—it’s not. The data shows that forbearance is low, and it’s extremely unlikely that we’ll see a foreclosure crisis in any shape or form.

Lastly, there’s inflation. As prices of goods and services increase across the economy, just as they are now, asset prices tend to increase as well. Housing is likely to be included in that equation.

Grow your real estate business and raise your game with other people’s money!

Are you ready to help other investors build their wealth while you build your real estate empire? The road map outlined in this book helps investors looking to inject more private capital into their business—the most effective strategy for growth!

Final thoughts on the Fed’s announcement

So, given the context of all these variables, what will happen to the market in 2022? Well, it’s up to each one of us to determine for ourselves how to weigh these various factors.

But if you want my personal opinion, here it is. The news from the Fed does not change my primary hypothesis that the housing market will cool down significantly in 2022 and will return to normal levels of appreciation. I do, however, think the market will cool faster and more significantly than I was expecting prior to this announcement.

Prior to yesterday’s announcement, I was expecting the first half of 2022 to see strong growth, with appreciation then tapering off throughout the year. Post-announcement, I believe price appreciation could be in the mid-single digits for the entire year. If I had to put a number on it, I think in December 2022 the median price of a home in the U.S. will be between 3% and 5% higher than it is in December 2021.

What do you think? How do you weigh these variables—and where do you see the housing market heading in 2022?