Today, we’re pleased to present a guest contribution by Laurent Ferrara (Professor of Economics at Skema Business School, Paris and Chair of the French Business Cycle Dating Committee).

Since President Macron announced the dissolution of the French Assemblée Nationale on Sunday 9 June 2024, France has been experiencing a period of political turmoil, with its economic consequences widely discussed in the media. The resignation of the Barnier government on December 5, 2024, has further heightened uncertainties about the country’s political and economic future. Measuring uncertainty and its effects is not an easy task, as this information does not exist in nature; it must therefore be calculated.

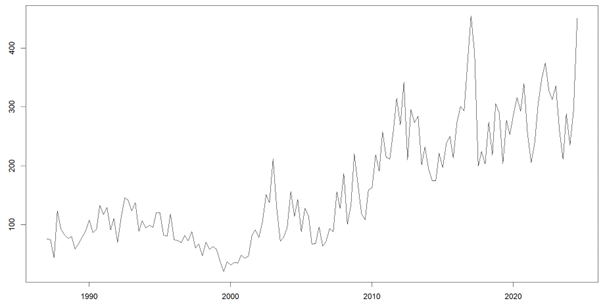

Economic policy uncertainty (EPU) has been at the core of recent major uncertainty shocks that have affected the global economy, ranging from suspicion of currency manipulation in China to the Brexit situation, through unexpected political elections outcomes. All those events generate uncertainties about the implementation of economic and social programs. Using text-mining methods, EPU indices of Bloom, Baker and Davis are now available for a large number of countries (see here on Econbrowser). Figure 1 presents quarterly EPU for France from 1987q1 to 2024q3. We see an upward trend starting from 2000s, as well as some peaks related to periods of tensions in France, as well as in the euro area in general (as the euro area debt crisis in 2012 or the recent political tensions in France).

Figure 1: EPU for France, quarterly average values from 1987q1 to 2024q3. Source: https://www.policyuncertainty.com/europe_monthly.html

Given the current background (post-Covid and energy crisis), current economic activity in France is so far rather good, as can be seen in Figure 2. The average quarterly growth rate is about 0.3% per quarter (about 1.2% at annual rate) over the post-Covid recovery, despite a sharp increase in ECB interest rates. France experienced an immaculate disinflation in the sense that the fight of ECB against high inflation rate did not generate an economic recession, as it used to be the case for example during the oil shocks of the seventies. Before the recent political turmoil, GDP growth forecast for 2025 was at 1.2% according to Banque de France.

Figure 2: GDP for France, 1970q1 to 2024q3. Source: Insee and AFSE Business Cycle Dating Committee

Some market variables have already reacted to the increase in EPU (see this Econbrowser post here). However, one important variable is very sensitive to EPU, namely business investment. As it is well documented in the literature, uncertainty mainly affects business investment, in particular the irreversible investment as discussed in the seminal contribution of Bernanke (1983). The basic idea is that, when investment projects are irreversible — that is, they cannot be “cancelled” or “modified” without very high costs — there exists a trade-off for investors between additional returns from immediately launching an investment project and the benefits of waiting for getting enough information in the future. The value of waiting is generally referred to as the real-option value in academic literature. Sometimes, it might be more desirable to postpone new investment projects and sometimes it might not. In such an environment, a rise in uncertainty would clearly tilt the balance in favor of a wait-and-see behavior. Indeed, by pausing their investment and hiring, investors would get more information about the future so as to increase their likelihood of making a good decision and thus to get a better understanding of long-run project returns. In the influential paper of Bloom (2009), the author highlights that “increased uncertainty is depressing investment by fostering an increasingly widespread wait-and-see attitude about undertaking new investment expenditures”.

In the case of France, business investment has already been showing signs of slowdown for the past year (Figure 3). In the third quarter of 2024, the latest available figure, the year-over-year change was -3.1%. Investment has now recorded four consecutive quarters of decline. This variable is crucial for assessing the possibility of a recession in France. It is one of the five variables considered by the business cycle dating committee of the French Economic Association, which has established a historical dating chronology of expansion and recession phases in France since 1970, in the vein of the NBER approach for the US. Therefore, a prolonged and significant decline in this indicator could be seen as an important signal of a potential recession in France.

Figure 3: Business investment in France, 1970q1 to 2024q3. Source: Insee and AFSE Business Cycle Dating Committee

To what extent is the sharp increase in EPU likely to amplify the drop in investment? In this respect, we can estimate an impulse response function to an EPU shock using the Local Projections method. To do this, the uncertainty shock must be correctly identified, and other macroeconomic variables (in this case, log-GDP and the 10-year sovereign interest rate) must be controlled for. When conducting this exercise, we get that a one-standard-deviation shock to the EPU indicator leads to a significant reduction in the log-level of investment of about 0.4% six quarters after the shock.

Figure 4: IRF of log-investment to an EPU shock estimated via Local Projections. Source: Author

Considering that the economic policy uncertainty shock observed in the third quarter 2024 represents approximately five standard deviations, this would imply an additional 2% decline in the level of investment within a year and a half.

This post written by Laurent Ferrara.