Consider the ruble/yuan exchange rate.

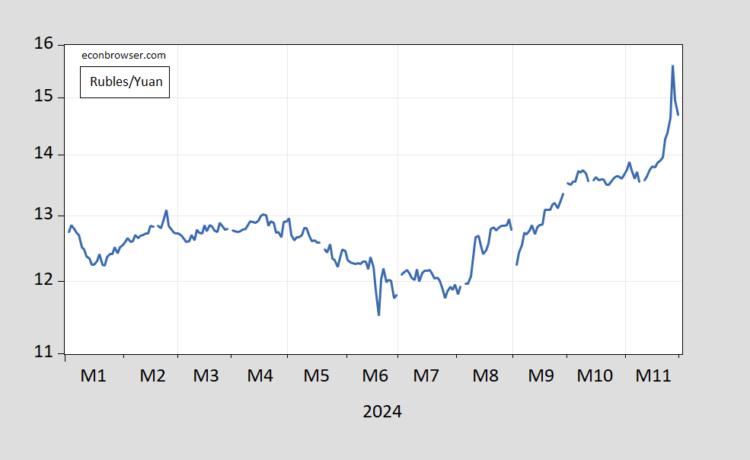

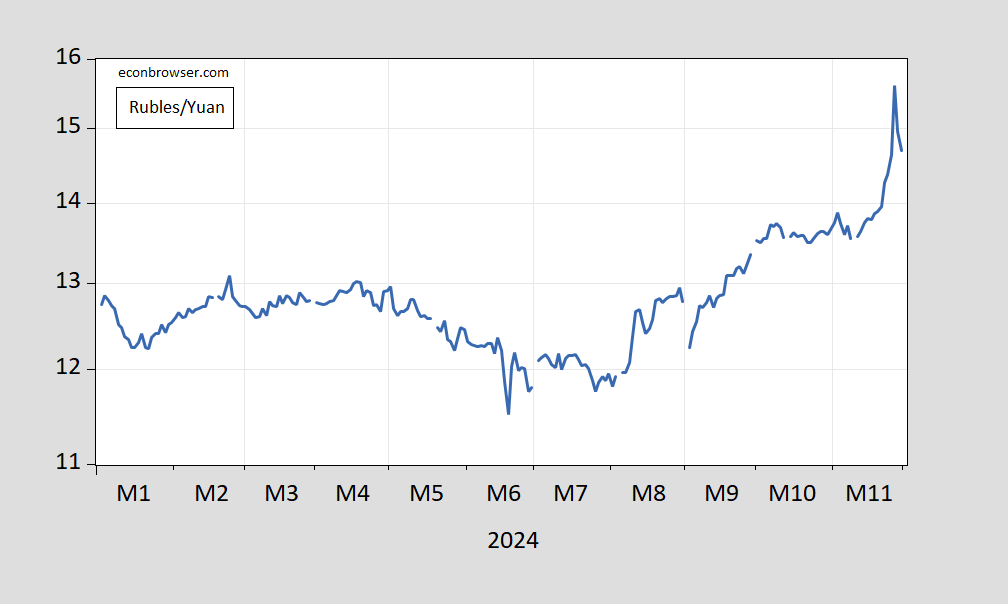

Figure 1: Rubles per yuan, calculated using dollar rates (blue, log scale). Up is a depreciation of the ruble. Source: Pacific Exchange Services accessed 12/1/2024, and author’s calculations.

The recovery in the ruble’s value after 11/27 was due to Central Bank of Russia intervention in the forex market.

While a devaluation makes the price of oil denominated in dollars higher in ruble terms (if the oil can be sold, now that Gazprom has been sanctioned), it has other effects on imported goods, including Chinese goods. As The Economist notes:

…a weaker rouble is a doubled-edged sword. A lower level against the dollar increases the rouble value of oil exports, helping plug the government’s widening deficit. Yet it also pushes up the price of imported goods—something that matters for both consumers and the government’s war effort. Analysts note that Russian imports of consumer goods usually rise as Christmas approaches. On November 28th Dmitriy Pianov, deputy chairman of VTB, Russia’s second-largest bank, told Interfax, a news agency, that the rouble’s decline over the previous few days was “a strong inflationary factor”. Moreover, China has become Russia’s most important trading partner in recent years, providing more than a third of all imports, as well as high-tech inputs that are crucial for the armed forces. The rouble has fallen by 7% against China’s yuan in the past month, which will raise the cost of military equipment.

Since October 1st, the ruble has depreciated 9% against the yuan. Taking literally estimates of exchange rate pass through at 3 month’s horizon from Ponoramu et al. (2016) (see table in this post), this means (in the absence of further depreciation) about a 5% increase in wholesale prices of imported goods from China.