For roughly 30 years, Wall Street and the investing community have been waiting for the next great innovation to come along that can rival what the advent of the internet did for corporate America. The rise of artificial intelligence (AI) just might be this long-awaited technology.

With AI, software and systems are used in place of humans to oversee and/or undertake tasks. The true value of AI lies in the ability of these systems to learn over time without human intervention. This allows AI-driven software and systems to become more effective at tasks and perhaps even learn new jobs over time.

Artificial intelligence represents an estimated $15.7 trillion opportunity by 2030

Although estimates are all over the map, as you’d expect from a still relatively unknown technology, the analysts at PwC released a report last year in which they estimate AI can add up to $15.7 trillion to the global economy by the turn of the decade.

With an addressable market this large, a lot of companies can come out as winners. But that doesn’t mean you can throw a dart at a written list of AI stocks and automatically make money.

For the moment, no company is more directly benefiting from the AI revolution than Nvidia (NASDAQ: NVDA). Since the start of 2023, Nvidia’s stock has gained up to $3 trillion in market value, with the company’s board recently approving a 10-for-1 stock split.

Nvidia’s otherworldly gains and textbook operational scaling are the result of its AI-driven graphics processing units (GPUs) becoming the standard in high-compute data centers. With demand for these chips absolutely overwhelming their supply, Nvidia has been able to meaningfully increase its prices and reap the rewards.

Unfortunately, every next-big-thing innovation over the last 30 years, including the internet, underwent an early-stage bubble-bursting event. This is to say that investors consistently overestimate the adoption and/or utility of new technologies, innovations, or trends. AI will need time to mature, just like every next-big-thing innovation before it, and that bodes poorly for Nvidia’s stock.

But not all artificial intelligence stocks would be in trouble if the AI bubble burst. Thanks to their foundational operating segments, the following five historically cheap AI stocks can be confidently bought for the second half of 2024.

Meta Platforms

The first cheap AI stock that you can gobble up with confidence for the latter half of the current year (and likely hold well beyond 2024) is social media giant Meta Platforms (NASDAQ: META).

The beauty of Meta’s operating model is that it generates close to 98% of its revenue from advertising. Even though CEO Mark Zuckerberg is aggressively investing in AI data centers, the metaverse, and various augmented/virtual reality devices, Meta’s prime social media “real estate,” coupled with lengthy periods of expansion for the U.S. and global economy, are what power its operating cash flow and profits at the end of the day.

As of the end of March, Meta was luring 3.24 billion users to its social media platforms each day. Advertisers are well aware that there’s no better alternative to reach users than to advertise with Meta.

Even after more than quintupling from its 2022 bear market low, shares of Meta can be purchased right now for less than 14 times estimated cash flow for 2025. For context, this is a 6% discount to its average forward-year cash flow multiple over the last five years and represents its lowest multiple to cash flow in every year over the last decade, save for 2022.

Alibaba

The next exceptionally inexpensive artificial intelligence stock you can buy without fear in the second half of 2024 is China-based e-commerce juggernaut Alibaba (NYSE: BABA).

According to the International Trade Administration, Alibaba is China’s top dog in online retail sales, with Taobao and Tmall accounting for an estimated 50.8% share of China’s e-commerce sales. Even with China’s economy stuck in neutral following the COVID-19 pandemic, an eventual strengthening of the country’s burgeoning middle class should lift the long-term prospects for this segment.

Further, Alibaba Cloud is China’s leading cloud infrastructure service platform by revenue. Alibaba Cloud is where generative AI solutions can be offered to customers to support and enhance their businesses. Enterprise spending on cloud services is still in its very early stages of ramping up.

Shares of Alibaba are currently valued at less than 8 times forward-year earnings, which is a steal when you account for its $85.5 billion in cash, cash equivalents, and various investments as of March 31.

Intel

A third AI stock that can shine in the second half of 2024, and likely well beyond, is semiconductor stalwart Intel (NASDAQ: INTC).

There’s no question that Nvidia has left Intel in the dust over the last 18 months. But in the second half of this year, Intel is releasing its Gaudi 3 AI-accelerator chip on a broad scale. With Nvidia unable to meet the demand of all its customers, Intel and its rivals should be able to easily grab share.

But there’s more to like about Intel than just its AI ties. Its legacy central processing unit (CPU) operations for personal computers and traditional data centers remain a cash cow for the company. This cash is being reinvested in various high-growth initiatives, such as the company’s foundry services segment. By 2030, Intel anticipates becoming the world’s No. 2 chip fabrication company.

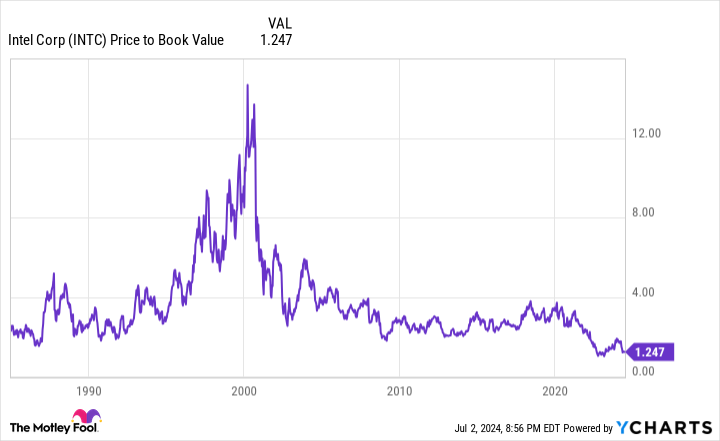

In terms of value, Intel is trading at 25% above its book value of $24.89 per share. With the exception of September 2022-March 2023, Intel stock hasn’t been this cheap, relative to its book value, dating back to the mid-1980s!

Baidu

The fourth bargain AI stock investors can confidently add to their portfolios for the second half of this year is China-based internet search titan Baidu (NASDAQ: BIDU).

Similar to Meta, Alibaba, and Intel, the bursting of the AI bubble wouldn’t derail Baidu. That’s because it’s China’s leading internet search engine. Over the trailing-10-year period, it’s pretty consistently accounted for 50% to 85% of internet search share for the world’s No. 2 economy by gross domestic product. This means predictable operating cash flow and strong ad-pricing power for Baidu.

However, AI represents the company’s future. Baidu’s AI Cloud is China’s fourth-largest cloud infrastructure service platform. Meanwhile, Baidu-owned Apollo Go is the world’s most successful autonomous ride-hailing service, based on total rides since its inception (more than 6 million). These non-online marketing segments have consistently grown at a faster pace than Baidu’s internet search engine.

A forward price-to-earnings (P/E) ratio of only 7 is unbelievably low for a company sporting roughly $26 billion in cash, cash equivalents, and short-term investments on its balance sheet.

Amazon

The fifth historically cheap AI stock begging to be bought for the second half of 2024 is Amazon (NASDAQ: AMZN), the world’s other dominant e-commerce player.

According to estimates, Amazon accounted for a nearly 38% share of U.S. online retail sales in 2023. But while this segment brings in plenty of revenue, it does little for Amazon’s cash flow or operating income. Where the company generates most of its growth and operating cash flow — and where AI will come in handiest — is its ancillary operations.

No segment is more important to Amazon’s long-term success than Amazon Web Services (AWS). AWS is the world’s leading cloud infrastructure services platform and recently topped $100 billion in annual run-rate revenue. AWS can deploy various AI and generative AI solutions to help businesses train large language models and run virtual assistants.

Don’t forget about advertising services or subscription services, either. These two segments are also growing by a steady double-digit percentage on a year-over-year basis. As Amazon’s e-commerce marketplace and content library grow, it should be able to command a premium subscription price for Prime.

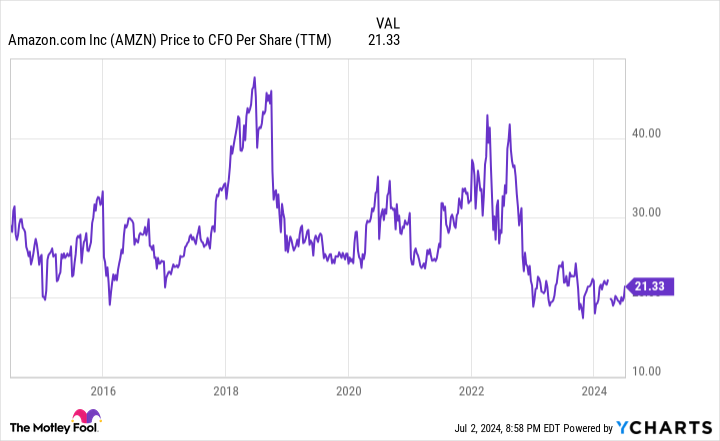

Although Amazon isn’t cheap based on the traditionally used P/E ratio, it is historically inexpensive relative to its future cash flow. Shares can be purchased right now for around 13 times the consensus cash flow in 2025, which is markedly lower than the median multiple of 30 times year-end cash flow investors gladly paid to own Amazon stock throughout the 2010s.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $751,670!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon, Baidu, Intel, and Meta Platforms. The Motley Fool has positions in and recommends Amazon, Baidu, Meta Platforms, and Nvidia. The Motley Fool recommends Alibaba Group and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

5 Historically Cheap Artificial Intelligence (AI) Stocks You Can Confidently Buy for the Second Half of 2024 (and Nvidia Isn’t 1 of Them!) was originally published by The Motley Fool