The Nasdaq-100 Technology Sector index has delivered impressive gains of 414% in the past decade, outperforming the S&P 500 index’s gains of 185% by a huge margin. A key reason why technology stocks have outperformed the S&P 500 during this period is because of their ability to deliver impressive growth as they can capitalize on disruptive trends. This is precisely why it would be a good idea for investors to buy and hold top tech stocks for the long run.

Super Micro Computer (NASDAQ: SMCI) and Oracle (NYSE: ORCL) are two tech stocks that are benefiting from artificial intelligence (AI), the latest disruption in the tech world that is impacting multiple industries and is expected to contribute significantly to the global economy.

Let’s look at the reasons why buying and holding these tech stocks for the next decade could turn out to be a smart move.

1. Super Micro Computer

Super Micro Computer manufactures server and storage solutions, and the stock has been on fire in 2024 with stunning gains of 208% already. However, Super Micro Computer still remains a top tech stock to buy and hold for the next decade because of three simple reasons.

First, the company is operating in a market that has received a massive boost thanks to AI. According to Statista, the market for AI servers is forecast to generate a humongous $430 billion in revenue in 2033 as compared to $31 billion last year. That translates into a compound annual growth rate of 30%.

The second reason to buy Supermicro is that it is becoming a key player in this lucrative market. That’s evident from the fact that it’s growing at a faster pace than the AI server market. The company’s revenue for fiscal year 2024 (which ended on June 30) is expected to land at $14.9 billion, which would be more than double the $7.1 billion revenue it generated in the previous fiscal year.

The fact that Supermicro is outperforming the AI server market is an indication that it is becoming the go-to provider of AI server solutions. As it turns out, Supermicro is also outperforming established players such as Dell Technologies. More importantly, KeyBanc analyst Thomas Blakey expects Supermicro’s AI server market share to increase to 23% this year, a level it will likely sustain in the future thanks to its competitive advantages.

If that’s indeed the case, Supermicro’s revenue could increase significantly in the long run thanks to the potential size the AI server market is expected to attain. This brings us to the third reason why buying this stock looks like a no-brainer now in light of the potential growth that it could deliver.

Super Micro is trading at just 4.4 times sales right now, which is lower than the Nasdaq-100 Technology Sector’s sales multiple of 7.4. Also, its forward earnings multiple of 25 is lower than the index’s reading of almost 30. With Supermicro’s earnings expected to clock an annual growth rate of 62% over the next five years, buying this AI stock looks like a smart move.

2. Oracle

The proliferation of AI is lifting Oracle’s boat as well. This is evident from the company’s recent quarterly reports, which point toward an improvement in the demand for its cloud infrastructure offerings.

For instance, Oracle’s remaining performance obligations (RPOs) in the fourth quarter of fiscal 2024 (which ended on May 31) increased 44% year over year to $98 billion. That was faster than the 29% year-over-year increase in its RPO in fiscal Q3 to $80 billion. This faster increase in Oracle’s RPO — which refers to the value of a company’s future contracts that are yet to be fulfilled — points toward an improvement in its future revenue pipeline.

Management expects its revenue pipeline to keep improving due to the growing demand for cloud-based AI services. According to a statement by CEO Safra Catz: “Throughout fiscal year 2025, I expect continued strong AI demand to push Oracle sales and RPO even higher — and result in double-digit revenue growth this fiscal year. I also expect that each successive quarter should grow faster than the previous quarter — as OCI capacity begins to catch up with demand.”

It is worth noting that Oracle’s revenue in fiscal 2024 increased 6% year over year to $53 billion. So, the forecast for double-digit growth in the new fiscal year suggests that AI is indeed set to drive stronger growth for the company. Another important point to note here is that Oracle signed more than 30 AI sales contracts worth more than $12.5 billion in the previous quarter. That number is very close to the $14.3 billion revenue that the company generated in fiscal Q4.

AI, therefore, is already driving the needle in a significant way for Oracle. The good part is that this trend is here to stay as the demand for cloud AI services is forecast to take off significantly in the long run. Fortune Business Insights estimates that the cloud AI market could grow from $60 billion last year to almost $398 billion in 2030, clocking a compound average growth rate of nearly 31%.

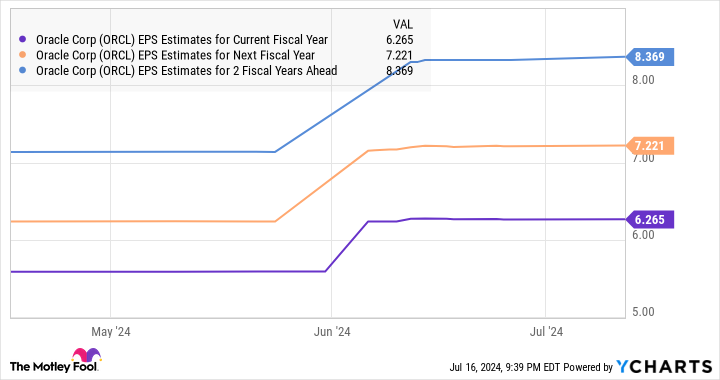

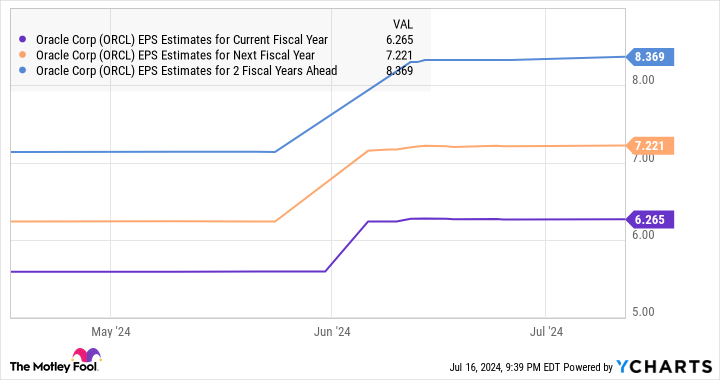

As a result, Oracle’s cloud business has a lot of room for future growth, which should positively impact the company’s overall business development. Not surprisingly, analysts are forecasting healthy double-digit earnings growth from Oracle over the next three fiscal years following a tepid increase of just 8% in the previous fiscal year to $5.56 per share.

With Oracle stock trading at just 23 times forward earnings right now, a discount to the Nasdaq-100’s multiple, now would be a good time to go long. Thanks to the multibillion-dollar opportunity in the cloud AI market, it could deliver more gains over the coming decade.

The stock is already up 35% in 2024, and it won’t be surprising to see it head higher thanks to the stronger growth it is expected to deliver.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,626!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool has a disclosure policy.

2 Tech Stocks You Can Buy and Hold for the Next Decade was originally published by The Motley Fool