Artificial intelligence (AI) is the hot trend on the market today. While there is certainly some hype associated with it, AI looks to have some staying power and is poised to have a real effect on the economy. People and companies are using AI to use and create all kinds of transformative applications. Photo imaging that’s never been done before and data analysis at unheard-of speeds are just two examples.

Businesses are harnessing AI’s power to run better and faster, and many of them are disrupting the status quo and capturing market share. Some of these companies are established winners who are using their robust assets to lead the charge, and others are small innovators disrupting the norm in niche segments of the economy.

Let’s look at an example from each category — Amazon (NASDAQ: AMZN) and Lemonade (NYSE: LMND) — and see why each could help you build a millionaire-maker portfolio.

1. Amazon: Leading with generative AI

Amazon has a long history of investing heavily in AI and is now turning its attention and resources to incorporating and expanding generative AI. It uses AI throughout its many businesses, but its most exciting opportunities for AI involve Amazon Web Services (AWS), its cloud-computing segment.

People who know Amazon predominantly as an e-commerce giant may not realize that it is also the leading cloud computing company globally. It’s a $100 billion run-rate business and has 31% of the global market. Amazon has developed a competitive set of generative AI tools for AWS users that simplify access and create incredible opportunities. It has an assortment of services in three tiers to meet different needs.

The foundational layer is for developers to build their own large language models (LLMs), which are the key basis for generative AI. These are models that have been trained on so much data that they can begin to create, or generate, without intervention. That’s what OpenAI’s ChatGPT is known for, and this is where Nvidia‘s chips come in. They’re powerful enough to handle the necessary data load to make this work, and it’s one of the main reasons Nvidia’s sales, and stock, have exploded over the past two years.

The next tier is for developers to use Amazon’s LLMs to generate AI for specific businesses, and the top layer involves turnkey solutions for businesses that don’t need custom-built services. One example is a tool that creates page descriptions for products on Amazon stores when a user inputs a URL.

AWS accounts for about 17% of Amazon’s total sales but 61% operating income. As AWS becomes a greater part of the whole, profitability could soar. Amazon stock typically follows the profits, and this could supercharge Amazon stock over the next several years, leading to incredible gains for investors who buy in now.

As with any great stock, becoming part of a millionaire-maker portfolio depends how much you invest and how long you wait. Some stocks can turn into millions on their own; if you’d invested $1,000 in Amazon stock at its initial public offering, you’d have more than $2 million today. I’m not sure it can do that again, but it can outperform the market average and contribute to a diversified portfolio of winning stocks that together can lead to millionaire-maker status.

2. Lemonade: A compelling AI disruptor

Lemonade uses AI to power its innovative insurance model. It’s a young company in operation for less than 10 years, and it has already attracted more than 2 million members and counting. It has reported steady and strong growth every quarter since it went public four years ago. In the 2024 first quarter, in-force premium, which measures average annual total policies, increased 22% year over year, and revenue increased 25%.

Lemonade has a key advantage over legacy insurers because it was built on a digital AI-powered infrastructure. All of its parts work together instantly, and management touts this connectivity as the core reason its model will eventually outdo the competition. Traditional models, which require more human intervention, won’t be able to keep up with Lemonade. However, it’s still building out its database as it grows quickly and adds new members and policies, so it’s taking time to reach that point.

Management gave one recent example where the AI mechanisms are already producing important results. In insurance, the loss adjustment expense (LAE) ratio measures how efficiently an insurer manages overhead expenses. The standard for large companies is about 10%, but Lemonade’s is 7.6% despite its small size. The company attributes this to its reliance on technology to handle claims, which increases efficiency while improving the customer experience. It expects this kind of impact to show up in more of its performance as it gathers more data.

In the meantime, it’s taking longer than investors would like to become profitable, and Lemonade stock still trades down nearly 90% from its all-time highs. Granted, that was when it was trading at a nosebleed valuation. But now it’s trading at 2.5 times trailing-12-month sales, which is dirt cheap for a growth stock. It may take some time, but Lemonade could be a standout stock when its algorithms kick in with better data and it starts to report profits.

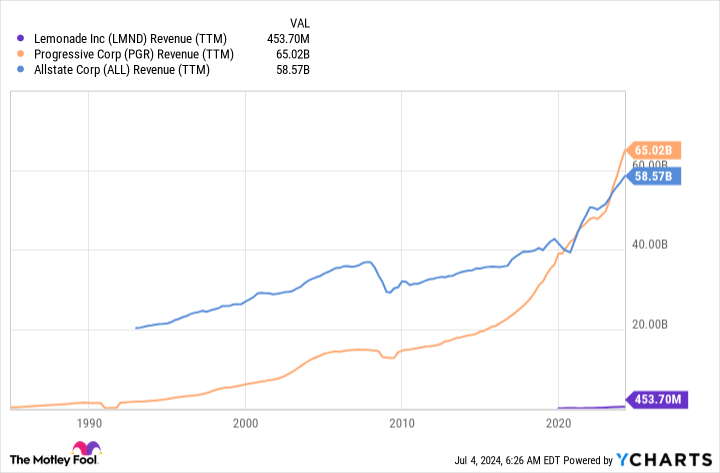

A large enough investment in Lemonade today could turn into $1 million over many years if Lemonade can turn its business profitable. Consider how small Lemonade is compared to industry leaders like Progressive and Allstate.

If Lemonade can grow to where it is generating revenue levels on par with its competitors, its stock could deliver serious returns and turn shareholders who go it early into millionaires.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $786,046!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 2, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in Lemonade. The Motley Fool has positions in and recommends Amazon, Lemonade, and Nvidia. The Motley Fool recommends Progressive. The Motley Fool has a disclosure policy.

2 Artificial Intelligence Stocks That Could Make You a Millionaire was originally published by The Motley Fool