Apple is the most valuable company in the world right now with a market capitalization of $3.4 trillion, but it’s closely followed by two other tech giants, Microsoft (NASDAQ: MSFT) and Nvidia (NASDAQ: NVDA). It’s worth noting that both Microsoft and Nvidia have taken turns becoming the world’s most valuable company this year, but Apple has managed to regain the top spot, thanks to a recent surge in the stock price.

However, if we compare Apple’s prospects to those of Nvidia and Microsoft for the next five years, it won’t be surprising to see them becoming more valuable than the iPhone maker. Below is a look at the reasons why.

1. Microsoft

Microsoft’s market cap of $3.3 trillion means that it’s strikingly close to Apple right now. More importantly, Microsoft is clocking faster growth than Apple, a trend that’s likely to continue over the next five years, thanks to the growing adoption of artificial intelligence (AI) in multiple markets.

For instance, Microsoft’s revenue in the third quarter of fiscal 2024 (which ended on March 31) increased 17% year over year to $61.9 billion. Meanwhile, Apple’s fiscal 2024 second-quarter revenue (for the three months ended March 30) was down 4% year over year to $90.8 billion. This stark difference in the performance of the two tech giants is largely due to AI.

While Microsoft is capitalizing on multiple AI-driven growth trends such as cloud computing, personal computers (PCs), and workplace collaboration tools, Apple has been late to the AI smartphone market. Microsoft’s Intelligent Cloud segment reported a 21% year-over-year increase in revenue in fiscal Q3 to $26.7 billion, driven by the growing usage of its cloud-based AI services.

The company pointed out that its Azure cloud business received a boost of 7 percentage points, thanks to AI. The cloud-based AI services market is forecast to generate $647 billion in revenue in 2030, clocking a compound annual growth rate of nearly 40% through the end of the decade, and Microsoft is sitting on a potentially large incremental revenue opportunity in this market.

Also, Microsoft Azure’s 25% share of the cloud computing market means that it’s well-placed to tap this multibillion-dollar AI opportunity. But this isn’t where the AI-driven catalysts end for Microsoft. The company’s Copilot generative AI chatbot, which serves both individual and business users, is witnessing healthy adoption.

For example, Microsoft’s Copilot for GitHub, a developer platform used by more than 100 million users, boasted of 1.8 million paid subscribers at the end of March. Meanwhile, the enterprise adoption of Copilot for workplace productivity remains solid. In the words of CEO Satya Nadella:

This quarter, we made Copilot available to organizations of all types and sizes from enterprises to small businesses, nearly 60% of the Fortune 500 now use Copilot and we have seen accelerated adoption across industries and geographies with companies like Amgen, BP, Cognizant, Koch Industries, Moody’s, Novo Nordisk, Nvidia, and Tech Mahindra purchasing over 10,000 seats.

Microsoft is charging $30 per user per month from enterprise customers for its Copilot. The individual plan is priced at $20 per user per month. So the company is already monetizing the AI-assistant market, which is expected to grow eightfold over the next decade and generate almost $167 billion in revenue in 2033.

The above AI-related catalysts indicate why Microsoft’s annual earnings are expected to grow at 16% a year for the next five years compared to Apple’s projected growth rate of 10%. This could eventually help Microsoft stock deliver more upside and become more valuable than Apple in the long run.

2. Nvidia

Nvidia is currently the third-largest company in the world, with a market cap of $3 trillion. Shares of the semiconductor specialist have surged a remarkable 745% since the beginning of 2023 as the likes of Microsoft and other tech giants have been looking to get their hands on its AI graphics processing units (GPUs) to train and deploy AI models and services.

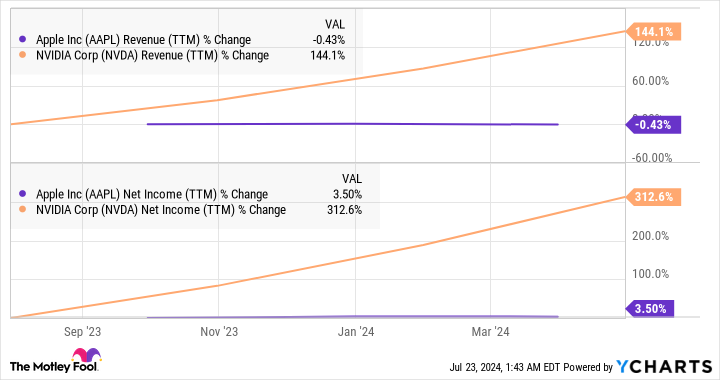

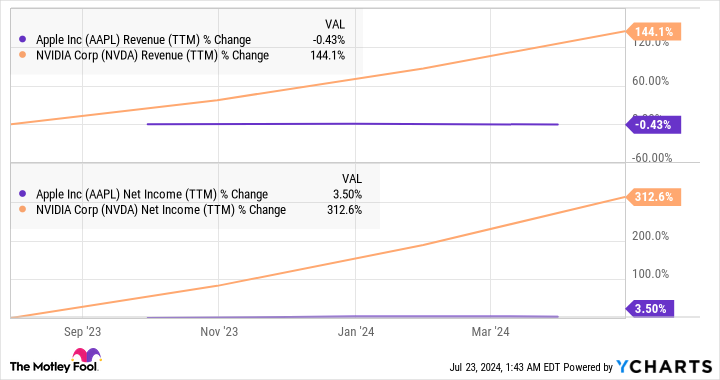

More importantly, Nvidia controls over 90% of the AI chip market. This terrific market share is the reason behind its outstanding growth in recent quarters, resulting in a much better financial performance than Apple.

With the global AI chip market estimated to grow tenfold in the next 10 years to become a $300 billion market, there’s a good chance that Nvidia’s outstanding growth will continue. According to some analysts, the company’s data center revenue alone could jump to $280 billion over the next four years from $47.5 billion in the previous fiscal year.

Throw in additional catalysts, such as the recovery in the PC market thanks to the adoption of AI-enabled PCs (which has started lifting Nvidia’s gaming business), and it’s easy to see why analysts are estimating Nvidia’s earnings to increase at 46% a year for the next five years. That’s significantly faster than the growth Apple is expected to deliver over the same period.

Of course, Apple could get a shot in the arm, thanks to the emergence of AI smartphones, but investors should note that the company is operating in a very competitive market. In the second quarter of 2024, Apple’s smartphone market share stood at 15.8%, down from 16.6% in the same quarter in 2023. Its shipments grew only 1.5% year over year as compared to the overall smartphone-market’s growth of 6.5%.

It’s easy to see why Nvidia’s growth is expected to be faster as it leads the AI chip market, while Apple operates in a crowded space where rivals have acted with alacrity in jumping onto the AI bandwagon. As such, the possibility of Nvidia overtaking Apple’s market share over the next five years, thanks to its faster bottom-line growth, can’t be ruled out, and AI is going to play a central role in helping the semiconductor company achieve that.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, BP, Microsoft, Moody’s, and Nvidia. The Motley Fool recommends Amgen, Cognizant Technology Solutions, and Novo Nordisk and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: 2 Artificial Intelligence (AI) Stocks That Could Be Worth More Than Apple 5 Years From Now was originally published by The Motley Fool